29 Oct 2024

.jpg)

By PSK's Chief Investment Office, Chris Lioutas

“Nothing to see here” was the first thing that came to mind in the September quarter given how exceptionally strong returns were. But that couldn’t be further from the truth given how action-packed the period was with bursts of heightened market volatility, a perplexing mix of economic data, and rising political and geopolitical risks.

Interestingly, the strongest returns came from yield-sensitive growth markets like listed property and infrastructure, and Australian equities which were also assisted by a rising Australian dollar. These asset classes benefited from a combination of central bank rate cuts (abroad) and declining bond yields all while inflationary trends remained somewhat stubborn in certain jurisdictions (namely, Australia and the US).

Relatively strong returns from bonds in the quarter, benefiting firstly from concerns regarding the economic outlook, and then from central bank rate cuts, both of which put downward pressure on bond yields and hence an uplift in capital values (growth). Corporate credit also performed well with strong buying from investors and healthy yield levels. Within equity markets, we saw a surprising change in leadership with Chinese equities rocketing higher on much-needed and eagerly awaited Chinese government and central bank stimulus.

Other market moves largely added confusion to the mix. The Australian dollar rose strongly against the USD, largely driven by the latter falling on concerns regarding the US economic outlook and the outsized initial rate cut from the Fed. Oil prices fell sharply in the period, seemingly appearing to better price in recession risks than equity and bond markets. Even a widening conflict in the Middle East wasn’t enough to arrest the decline in oil prices. Increasingly noticed and watched gold prices rose in the quarter, likely pricing in concerns regarding potentially stickier inflation and a weaker economy and hence a lower bond yield environment.

All this played out in a backdrop where the economic picture and outlook became increasingly obfuscated, with different asset classes pricing in or exhibiting different economic expectations. A couple of sharp and sudden changes in expectations in the quarter saw some rather large single day falls in equity markets, with US tech front and centre, which provided proof points of the lofty expectations already baked into asset prices and little sneak-peeks at what happens when markets price risks correctly.

A mixed bag across the globe on the inflation front. Cheers of success in Europe, the UK, Canada, and New Zealand; inflation remaining somewhat stubborn in Australia and the US linked to services (tight jobs market) and property-related factors (supply, rents, construction costs); deflationary risks persisting in China; and rising inflation in Japan. The June quarter Australian inflation print showed some inroads being made, with subsequent data resulting in the RBA taking further rate hikes off the table, but with underlying inflation still too high for rate cuts. US inflation, particularly headline inflation, saw growth slow significantly in the period satisfying the Fed enough to cut rates by a large 0.50%! Interesting move with core inflation above target, particularly with inflation re-accelerating slightly at the back end of the quarter.

Inflation at or very close to target saw central banks in England, Canada, New Zealand, and a few others cut rates in the period, whilst the Bank of Japan raised rates for only the second time since 2007 putting significant upward pressure on the Yen. This move resulted in significant market ructions as many traders were forced to swiftly unwind huge cross-currency positions. In contrast, both the US and Chinese central banks cut interest rates for very different and perplexing reasons, with Chinese officials succumbing to pressure to provide much needed stimulus to the property and household sectors.

In one of the oddest central bank decisions in recent history, the US Fed cut rates by what has historically been seen as an emergency level cut – 0.50%. All whilst communicating the economy remains strong, labour markets tight, and core inflation still well above target. The move caused confusion amongst non-equity investors (bonds and commodities) whilst equity investors took out the champagne and didn’t look back.

On the economic front, a “soft-landing” remained the consensus, but we did see markets attempt to price in both hard-landing and no-landing scenarios in the period, with investors realising a soft-landing scenario isn’t a foregone conclusion. Headline economic data remained robust in most jurisdictions (outside of China) but underlying and less well-followed data did start to show signs of weakness in the period – something we’ve been watching closely as headline data generally operates with quite a considerable lag and is subject to large revisions. This was true on the Australian economic front – unemployment was still very low but jobs growth was patchy with quite large declines in job ads; healthy house price growth and anaemic bad debts, but signs of some weakness in NSW and particularly VIC, with increasing supply of existing homes for sale, whilst rental markets remained very tight; cumulative household savings high, but household savings ratios moved below pre-covid levels and retail sales growth continued to slow. The same was roughly true of the US economic backdrop.

China’s economic woes became significantly more apparent in the quarter forcing Chinese officials to act. The household remains pained by the significant falls in house prices, with most Chinese household wealth tied up in property, maintaining downward pressure on both confidence and sentiment. Manufacturing data also remained weak given lacklustre demand from local and global customers (e.g. Germany) and the imposition of tariffs by both the US and Europe as the trade war continued. Finally, foreign investor outflows haven’t helped but we did see that change somewhat in the period (off a very low base) following the announcement of stimulus measures.

Plenty of action on the political and geopolitical front, with the US election nearing, a stalemate in French elections (which markets applauded), escalations from the conflict in the Middle East and Western trade tensions with China (chips and electric vehicles). President Joe Biden succumbed to pressure from within, pulling out of the Presidential race with the Democrat Party anointing sitting VP Kamala Harris as their primary candidate. Former President Trump withstood two assassination attempts on his life, whilst both Harris and Trump announced their VP choices and hit the campaign trail. Tensions in the Middle East rose as the Israel / Hamas war extended to Yemen, then Iran, and more recently Lebanon. Markets stood up and took notice, whilst oil prices oddly remained weak in the period.

Outlook

The outlook remains a juxtaposition between deteriorating economic fundamentals, stubborn inflationary thematics, and government and central bank officials hell-bent on trying to ensure they hold onto every job gain over the last few years whilst bringing inflation back to target in a credible timeframe and alleviating cost-of-living pressures to shore up re-election chances. Equity investors desperately want (need) to believe, and bond investors want to price rising risks but are prevented from doing so due to significant bond supply and somewhat unorthodox fiscal and monetary policy, whilst commodity investors are pricing in significant economic woes in the absence of gargantuan Chinese stimulus.

We’re continuing to err on the side of caution in light of this given the heightened risks of policy missteps, overcrowded trades, and quite full valuations which in some cases imbue fairly lofty expectations. But we’re also checking this caution against fiscal and monetary policy which, at least in the short term, has the ability to patch over and/or hide any of the negativity that usually follows a period of significant rate hikes. A balanced and diversified approach is sensible for now.

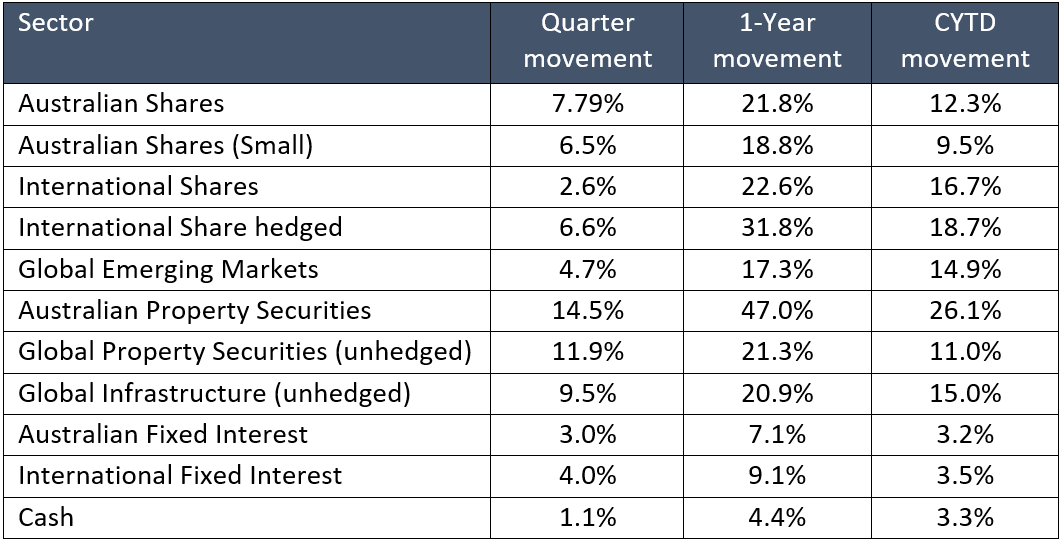

Asset Class performance – September Quarter 2024

Source: Morningstar Direct

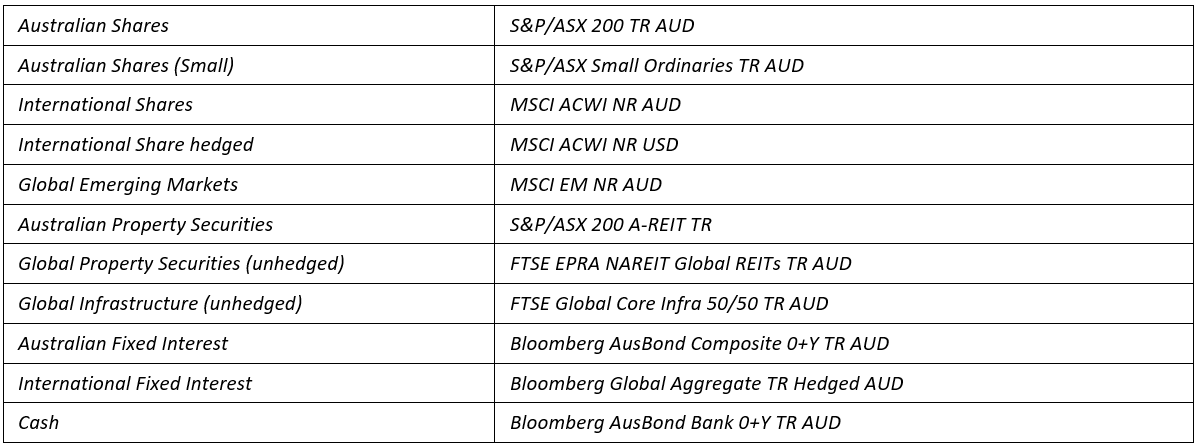

Indices:

As always, if you have any questions or your personal circumstances have changed please do not hesitate to contact your financial adviser.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.