29 Apr 2025

By PSK's Chief Investment Office, Chris Lioutas

Every so often we get a quarter where the events immediately after the quarter make the period in question seem like a distant memory… this was certainly one of them!

However, upon review, it was still an action-packed quarter.

January got off to a good start for markets, following a weak December. Chinese artificial intelligence (AI) made its way onto the global stage with DeepSeek revealing potential advancements in both computing power and energy efficiency. This spurred investors back into Chinese equities, and Chinese tech in particular, which saw further outflows out of Indian equities, whilst US tech investors took stock on the potential competitive threats to US A.I. superiority.

The change in investor priorities saw the beginning of a rotation out of last year's winners into unloved or under-owned parts of the market, including China, Europe, and value stocks more broadly. On the central bank front, we saw the US remain on hold and the European central bank cut again, whilst the Indian government and central bank unleashed stimulus to buffer their weakening economy, being acutely aware of looming US tariff effects. Chinese economic data continued to see some improvement, off a low base, with firms front-loading manufacturing and production again with looming US tariffs on the horizon.

Donald Trump was inaugurated as the 47th US President which ushered in a raft of executive orders, most of which investors took well. This positive momentum continued into early February supported by robust US company reporting season results. Australian reporting season results were also reasonable but culminated in unusually high volatility. Central bank rate cuts also provided a positive impetus for investors with the Bank of England, Bank of India, and our own RBA obliging. The RBA decision was an interesting one, on the eve of a potential federal election. We expected them to cut given wider pressure to do so, and with inflation trending in the direction, but they could have easily held the line.

Investor sentiment then soured as Trump delivered on key election promises to secure the US border which included significant tariffs on Canada and Mexico, along with China (fentanyl), with China retaliating back almost immediately. Additional tariffs included 25% on all aluminium and steel which impacts Australia. The tariffs on the US’s key trading partners, along with the ongoing investigations into government expenditure (DOGE), saw US leading economic indicators take a dive for the worse, with sagging consumer/business confidence and sentiment given potential inflationary impacts of the former and economic growth detractors of the latter.

On the political and geopolitical front, negotiations got underway to try and resolve the Russia/Ukraine and Israel/Hamas conflicts and Germany ushered in a new leader from the centre-right party. The change in leadership in Europe’s largest economy also saw the Germans break with long-standing self-imposed fiscal constraints, announcing large infrastructure and defence spending plans, with the European Union also announcing their own large defence spending plans. The moves came as US / Ukraine negotiations flopped rather embarrassingly in a public forum which saw the US cease all aid to Ukraine. With the benefit of hindsight, this was possibly the “kick up the backside” the Europeans (and Germans) needed to shift their fiscal stances. The significant spending initiatives saw additional support for European equities, and new support for the Euro, whilst European bond yields surged higher.

The much talked about tariff announcements from February saw implementation in March with additional new subsidies for US agriculture which saw retaliation from China. Markets didn’t like the size of the tariffs, particularly against US key trading partners, with US inflation expectations rising on fears any tariff-induced inflation may make it harder for the US Fed to provide rate relief. China data also began to show signs of weakness again, with much of the front-loading of economic activity ending abruptly. Closer to home, Australian employment data was significantly weaker than expected, showing the first signs of cracks appearing.

The US Fed kept interest rates on hold again but made rather material adjustments to their inflation (higher) and economic growth expectations (lower) for 2025. Pleasingly, US politicians agreed to keep the government open (yet again) agreeing to a continuing resolution which maintained their ability to spend in the forward period.

To round out the quarter on the political and geopolitical perspectives, the US launched an offensive on Yemen’s Houthis in order to protect US (and Western) shipping lane access. Clearly, the Trump administration had had enough, but the move came with sabre-rattling rhetoric directed at Iran given their suspected financing and support networks in the region which again saw tensions rise. In contrast, Russia and Ukraine reached a deal for partial ceasefires, whilst the US restarted some aid to Ukraine.

The Australian federal budget was released in the quarter with the Labor government delivering an underlying cash deficit on the eve of an election as the Albanese government pitched for a second term. The budget came with surprise tax cuts but showed an expected worsening in both deficits and debt over the foreseeable future in trying to keep the economy afloat.

The quarter rounded out with investor trepidation as April 2 loomed – “Liberation Day” as termed by Trump and his administration – with significant tariff announcements expected including much anticipated reciprocal tariffs. Fair to say investors, and much of the world, held their breath in anticipation.

All in all, an action-packed quarter with trade tariffs and geopolitical uncertainty, A.I. disruption threats, monetary policy divergence, renewed inflation concerns, sector and country rotations within equities, and fiscal stimulus in Europe.

Outlook

Looking ahead, it’s clear that investor sentiment and economic outcomes will be dominated by tariff/trade news along with US Treasury initiatives including debt refinancing and budget deficit reductions, and a ramp-up in US oil production.

The key will be the trajectory and landing spot for the US economy, global growth gave the backdrop of deglobalisation, navigating through tariff-induced volatility impacting consumer and business confidence and inflation, and increasingly complex geopolitical tensions.

These present both risks and opportunities given the likely weaker economic period ahead, the potentially inflationary imposts of tariffs, and the rather quick fashion in which some of these issues can be resolved.

For now, given the state of flux on tariffs, we’re adopting a more cautious approach to the outlook with increased vigilance and monitoring. In these environments, we remain agile, well-diversified, and focused on identifying higher-quality opportunities with valuation support.

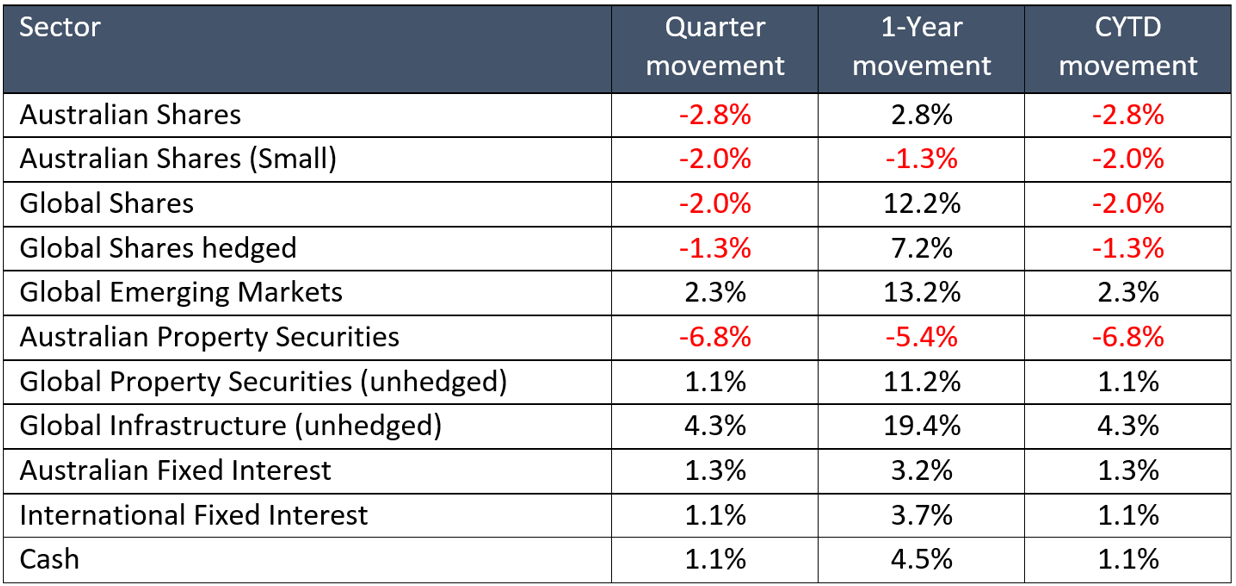

Asset Class performance – March Quarter 2025

Source: Morningstar Direct

Indices:

.png)

As always, if you have any questions or your personal circumstances have changed please do not hesitate to contact your financial adviser.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.