29 Oct 2024

Article written by the PSK Investment & Research team

This month, we summarise the process we use when we select managed funds for use in our portfolios.

While the analysis / assessment of any product is somewhat backward-looking, our analysis aims to be as forward-looking as possible. That includes a particular focus on whether the product / manager’s success is repeatable, whether the market environment now and in the medium term is conducive to the particular style of investing, and whether the team dynamic and quality staff will remain with the organisation into the future.

Canvas asset class / investable universe based on portfolio parameters / requirements.

In order to research investment opportunities, we need to build a strong understanding of the opportunity set of funds available in Australia. This involves reviewing both currently available funds, and gaps in the opportunity set that could be fulfilled by funds available overseas, should they be brought to Australia. Broadly, our investment universe is completely open (i.e. we have no inherent biases), however specific portfolios and individual clients will have their own requirements that often need to be met.

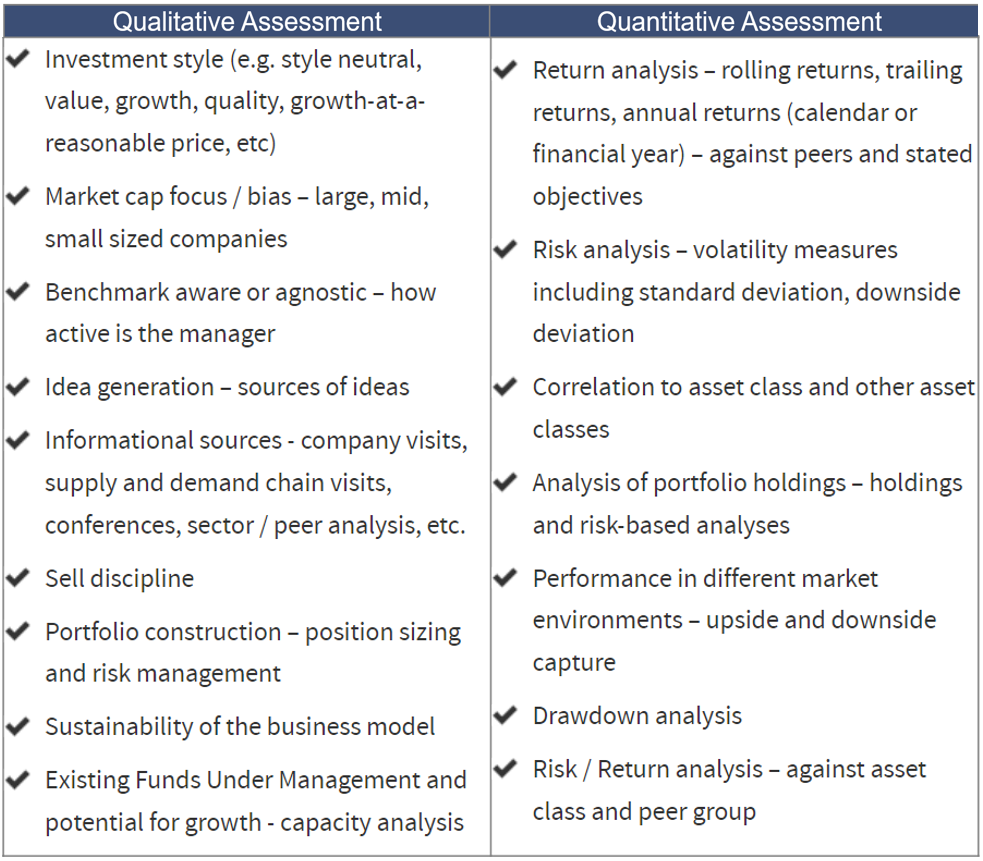

Conduct the analysis using both Qualitative and Quantitative measures – as discussed below.

At this step, we will make an initial assessment on which funds we want to spend time meeting with, and which funds are not meeting initial hurdles. This involves a desktop review of qualitative information (e.g. pitch decks from fund managers) and quantitative information (e.g. performance and risk metrics). Some of the metrics we look at include:

Once we decide to pursue further research with a fund, we will proceed to step 3.

Manager Meeting

On a stand-alone basis, this is the most important part of the manager’s research and selection process. The key steps involved in this process include:

- Meet with Portfolio Managers, focussing our meeting on the “5 P’s”

- People – who is running the fund and what is their background

- Process – what process does the team follow

- Parent – an assessment of the broader business the fund is part of

- Price – where do fees sit relative to the quality of the manager and peers

- Performance – both historical performances, and forward-looking expectations

- Meet with senior analysts or other key decisions makers / inputs to gauge the depth and breadth of the team, ensure consistency of process, and see how idea generation works in the team.

- Second meeting with Portfolio Manager(s) – this is very important as we seek to identify any discrepancies from the first meeting, to ensure the manager is consistent in their comments, and to cover any issues raised after a review of the first meeting. We’re ensuring there is a clear link from the investment research they undertake to the end portfolios.

- Review their systems / research process.

Portfolio Construction - allocation

This step does not follow a regimented process, but the questions below are some of those we ask ourselves before providing the final recommendation and implementing it.

- What allocation will the fund receive? What will drive this (risk vs return, conviction)?

- Does the fund fit into the existing portfolio?

- Where the portfolio is new, can exposure be built around the strategy in question?

- Are the incumbent or proposed products complimentary?

Ongoing Monitoring

The appointed fund managers and product providers are monitored to maintain timely awareness of any issues impacting their operations, capability and performance and hence on clients’ investments. Any significant events impacting an investment’s process or team are reviewed and assessed for the impact they may have on the capabilities and ability to achieve expected outcomes. We have an extremely high level of engagement with the providers of the investments used in the portfolio. We have service level “agreements” with these providers in terms of news flow and information (e.g. data) we require on an ongoing basis.

In addition, we also conduct the same monitoring on a “reserves” or "bench list" of managers to ensure our readiness in case a change is required. This ensures we are always ready to replace a manager if required and we don’t get too comfortable and/or complacent with incumbents.

Once a trigger for a deeper review has been identified, such as a key event or persistent issue, the product provider and the affected products are reviewed to form a view on the providers’ ability to rectify the problem. The analysis will include an understanding of the issues, what is driving the observed outcome and realistically assess the fund manager’s ability to rectify the situation and meet investment expectations within a short time frame. This may result in a change in view, either on an absolute basis (the fund manager is no longer expected to meet its objective) or a relative basis (the fund manager is less likely than peers to meet its objective). When our view changes, our bench list of managers under coverage becomes very important.

The Investment & Research team at PSK are always monitoring market conditions and data points to ensure portfolios align with our overall long-term objectives. If you’d like to discuss any of the points raised, please contact your Adviser or call us on (02) 8365 8300.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.