25 Jun 2024

.jpg)

Article written by PSK Investment & Research team

This month, we look at why trying to “time the market” is an exercise that historically has been rendered a “fool’s errand”.

“I am concerned about investing in the market right now given the uncertain environment and general volatility. I want to wait until conditions improve”.

The above statement is one you may have heard before. This approach is referred to as ‘market timing’ and involves making investment decisions and building a strategy based on short-term market movements. What many don’t realise is market timing involves two key decision points – firstly, either holding back from deploying money into the market or pulling money out of the market (fear); and second, when to deploy money into the market or go back into the market (comfort).

This behaviour is often driven by “loss aversion” – the desire to avoid additional losses because losses feel more painful than gains feel good. However, what most investors don’t know is how closely the best days often follow the worst, and how important those good days are to the recovery of a portfolio. Most short-term, temporary type events, at the end of the day, tend have limited impact on markets. Getting the entry and exit timing calls right is incredibly difficult and impossible to get correct on a consistent basis.

It is always difficult trying to convince investors to deploy cash into an environment where they feel uncomfortable, such as periods of heightened volatility and/or falls in asset prices. The usual response is to believe that leaving money in a bank account / defensive assets while waiting for concerns to subside is the safe play. However, if you have a long-term investment horizon, sticking to your plan (eg. risk profile / asset allocation / strategy), when it comes to investing, is always the best course of action. Further to that, and as uncomfortable as it might feel, potentially taking advantage of weak conditions during times of market stress can assist in making your money work harder for you. Trying to ‘time the market’ has always been a fruitless exercise and in most cases, it ends up costing investors’ money. A vast amount of research over the years shows a buy-and-hold, long-term approach to owning assets produces better long-term results.

For example, as we moved into 2023, the world was convinced the U.S. was heading into a recession. This would be the first card to fall, which would then cause most developed economies to follow suit. With the significant rise in central bank cash rates, more than 40-year highs in inflation, and the expiry of gargantuan Covid-era fiscal stimulus, the slide into recession seemed inevitable. Inverted yield curves (when short-term bond yields are higher than long-term bond yields), historically an accurate predictor of pending recession, seemingly justified these calls. Fast forward 18-months and U.S. share markets have hit record highs (with 14 of the world's 20 largest share markets at or near their record highs with recession fears all but gone. The Australian market followed suit in March and has hit new peaks five times in Q1 alone. Markets don’t always follow the logical course of action and can be illogical for much longer than expected.

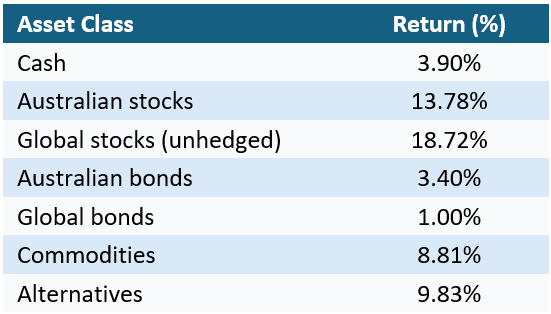

In the table below, you can see the performance of major asset classes from 1 July 2023 to 22 May 2024.

Source: Bloomberg, MSCI

Appreciating the fact that entry points vary, the table shows the level of return one has potentially missed out on if they stood on the sidelines or overextended into defensive assets (cash/bonds).

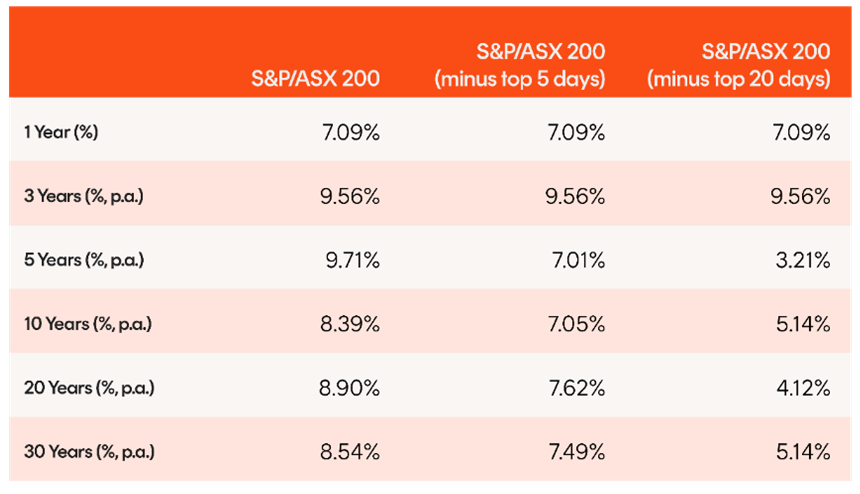

Betashares have also crunched the numbers using the S&P/ASX 200 benchmark index, and their analysis showed just how big a difference it can make when investors miss out on a handful of the biggest rallies.

Source: Bloomberg, Betashares. As at 31 January 2024. Past performance is not indicator of future performance. Top five and top 20 days since over the last 30 years have been removed from the respective data sets. None of these days occurred in the past year so one-year returns are unaffected.

Over the past 12 months to the end of May 2024, these results have been even more extreme.

The S&P/ASX 200 returned 12.93%. If you missed the best 5 and 20 days, your returns fell significantly, 4.39% and -11.98% respectively.

An additional chart below illustrating much of the same thing but using the US equity market.

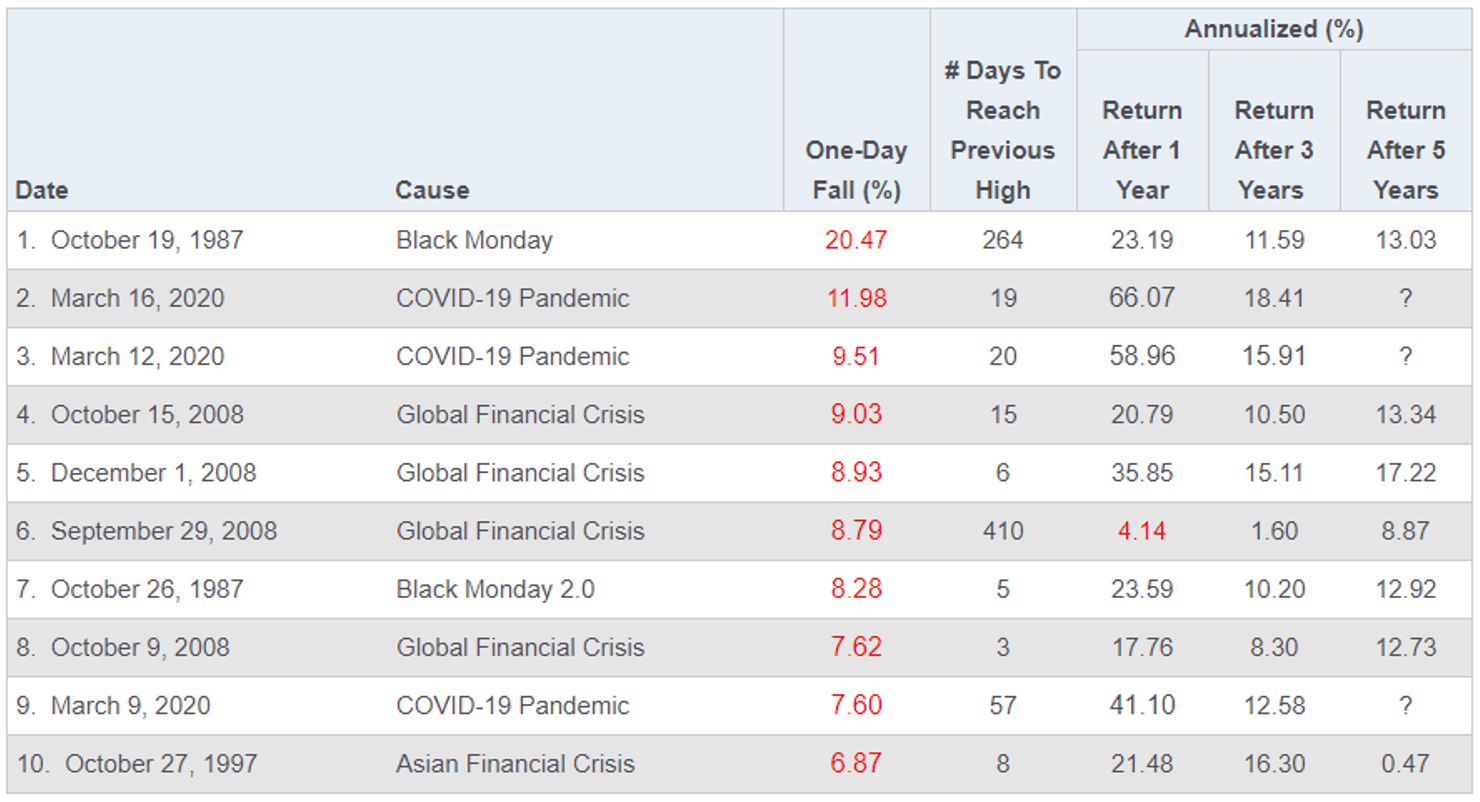

One year after each of the US S&P 500 Index’s 10 worst one-day drops, the Index notched double-digit positive returns in all but one instance—and remained positive three and five years later.

The chart below doesn’t include reinvested dividends, which would have made returns even higher.

10 Worst Single-Day Percent Declines for US Stocks 1981-2024

Past performance does not guarantee future results. Data shown is for the S&P 500 Price Index as of 12/31/23. Indices are unmanaged and not available for direct investment. Data Sources: Morningstar, Ned Davis Research, and Hartford Funds, 1/24

As you will notice, even events which were considered catastrophic for equity investors, didn’t hold back equity markets for too long.

Investment manager JP Morgan revealed that timing the market is almost impossible to achieve given that good and bad trading days fall so closely together.

As at the end of 2021, seven of the best days in the U.S. had occurred within two weeks of their corresponding worst day; but often the gap between the best and worst days was much shorter.

For example, March 12, 2020, was the second-worst day of the year in U.S. share markets, yet that was immediately followed by the second-best day of the year.

JP Morgan’s study found the worst days overwhelmingly occurred before the best days: over the last 20 years, six of the seven best days occurred after the worst day.

A well-diversified portfolio aligned to a disciplined investment strategy is and always will be the best way to build long-term wealth. In contrast, and as shown above, trying to time the market is fraught with complexity (ie. multiple decision points) and endangers long-term wealth creation.

A long-held adage of investing still holds: “It is important to remind investors that success is achieved through time in the market, not timing the market.

The Investment & Research team at PSK are always monitoring market conditions and data points to ensure portfolios align with our overall long-term objectives. If you’d like to discuss any of the points raised, please contact your Adviser or call us on (02) 8365 8300.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.