30 Jan 2025

.jpg)

Article written by PSK Investment & Research team

Economic indicators and data were mixed throughout most of 2024, with periods of strong data leading to optimistic markets quickly followed by weaker data points leading to pessimistic markets. Market expectations for economies around the world continue to change quickly, including in Australia.

2025 Australian Economic Outlook

- Inflation will continue to fall gradually in 2025, with risks tilted towards inflation reaccelerating or falling more slowly than expected.

- GDP (economic) growth will remain low but positive, avoiding recession territory (two consecutive negative quarters).

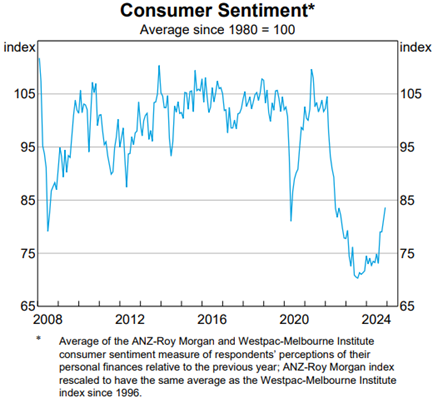

- Consumer confidence will start to lift, assisted by a few rate cuts through the year and higher real (after inflation) household income.

Growth in 2024 was much slower than the years prior. While Australia avoided recession, the economy looks likely to have experienced its slowest GDP growth in 32 years (excluding the pandemic) despite higher-than-normal population growth.

.png)

Source: ABS.

This slowdown in growth has been driven by three key factors:

- High inflation

- Low household consumption

- Low consumer sentiment

For GDP growth to improve from here, these three key issues need to reverse. Market and economic consensus are currently forecasting a modest recovery in growth in 2025, largely citing an improvement in inflation and real household incomes, leading to a recovery in demand. While we agree that this scenario is likely, we feel that risks are tilted to the downside, meaning we may see another year of very slow growth.

There are two primary measures of inflation; headline inflation (the measure targeted by the RBA) and underlying inflation, which excludes volatile items such as food and energy prices. Headline Inflation has fallen a long way from its peak of 7.9% in December 2022 to 2.9% in the September quarter, primarily driven by disinflation in goods and a moderation in services inflation. Headline inflation also includes the impact of government cost of living support to households, the largest being the energy rebates. Lower demand has also helped reduce inflation, which is likely to continue into 2025.

.png)

Source: Macrobond, November 2024.

Underlying inflation remains elevated at 3.5%. Food and commodity inflation has started to pick up which will eventually feed into goods inflation. For underlying inflation to slow further, services inflation will need to ease. Subdued economic growth is likely to increase the unemployment rate. This will place downward pressure on wages growth, and therefore services inflation.

While the inflation falls are positive, there remains a risk that inflation reaccelerates from here. Energy rebates are scheduled to end later this year, which will temporarily increase the headline inflation number. President Trump’s plan for increasing tariffs could increase prices globally, while also increasing uncertainty and disruption. The low Australian dollar (AUD) relative to the US dollar (USD) also presents upside risks to inflation, as imported goods will cost more in AUD terms (we will cover currency in more detail next month).

Australia’s historically low productivity levels may also keep labour costs high, which places upward pressure on inflation. Any acceleration will reduce consumer confidence and real household incomes, likely reducing consumption and therefore GDP growth. A good outcome in 2025 would be for inflation to remain at current levels.

2025 will also see an Australian Federal Election, likely to be held in May. The lead-up to this election is likely to see policy announcements aimed at supporting growth. Larger government spending is positive for GDP in the short term, however over the long term this is often associated with higher inflation, potentially higher interest rates, and weak productivity (especially if the public sector crowds out the private sector),

Any increase to inflation could also be exacerbated if the RBA cuts rates too soon or too fast, presenting a headwind for rate cuts in 2025. At the same time, growth has slowed materially and may continue to slow into recession territory if rates are kept high for too long. Headline inflation is within the RBA’s 2-3% target range for inflation, which provides scope for the RBA to begin cutting interest rates. The path for rate cuts is highly uncertain. The February RBA meeting decision will likely rest on the outcome of the December CPI report, due late January.

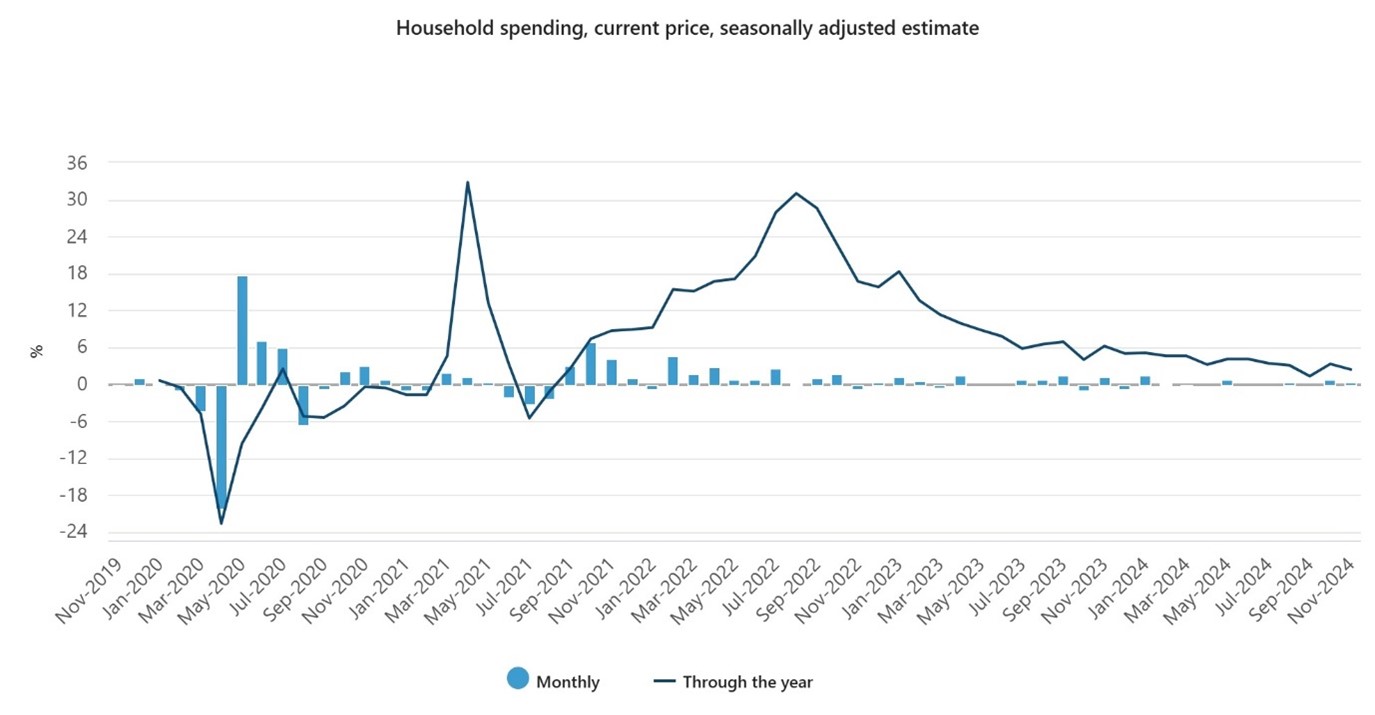

Real household consumption is growing at a low 2.4% (annualised) as of November 2024, which against strong population growth means there has been a contraction in the volume of spend per person. This change in individual consumption is what a household feels, rather than the growing headline number.

We expect that this will slowly pick up in 2025. Stage 3 tax cuts implemented in the second half of 2024 boosted household disposable income, however very little of this was spent by consumers, largely due to low consumer sentiment levels. Lower inflation levels also improve real household incomes and purchasing power.

Source: Australian Bureau of Statistics, Monthly Household Spending Indicator November 2024

Rate cuts often boost consumer sentiment, and given inflation is likely to fall in 2025 and the RBA is likely to cut, we expect sentiment to improve slowly throughout the year. While consumers are likely to remain more cautious than confident, we expect the late 2024 pick-up in consumer sentiment to continue, which is positive for consumption and will support growth.

Sources: ANZ-Roy Morgan; RBA: Westpac and Melbourne Institute.

What does this mean for portfolios?

While our economic outlook is cautious, as we have noted previously, trying to time a correction is fraught with danger. It is important to position portfolios for a range of scenarios, with a long-term focus in mind.

To discuss the impact of our outlook in relation to your portfolio, please speak with your PSK adviser.

The Investment & Research team at PSK are always monitoring market conditions and data points to ensure portfolios align with our overall long-term objectives. If you’d like to discuss any of the points raised, please contact your Adviser or call us on (02) 8365 8300.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.