19 Dec 2024

.jpg)

By PSK's Chief Investment Office, Chris Lioutas

2024 was a year of extremes, a year in which not a lot made any sense, and a year in which investors carried a smile from ear to ear as asset prices powered ahead.

The year started with a bang, as the positive market momentum from the fourth quarter of 2023 spilled over into the new year under the premise that inflation would fall sharply through 2024 enabling central banks to deliver large rate-cutting programs.

However, by the end of the first quarter, it became fairly apparent that the easy wins on the inflation front had been had and getting inflation back to target wasn’t going to be easy. The US central bank turned hawkish (combative on inflation) and geopolitical tensions rose in the Middle East and Ukraine. Equity markets weakened as a result.

Interestingly, markets then seemed to move the goalposts from failed expectations of significant interest rate relief to a “soft landing” narrative which ended up being the central mantra for the year – a goldilocks situation in which inflation comes under control, central banks provide rate relief, economic growth slows but remains reasonable, all with very little job losses. Nice if you can get it, particularly with history showing these environments are few and far between. The pivot and newfound belief saw equity markets rise.

May and June saw another interesting dynamic. A slew of weaker economic data put the soft-landing narrative at risk, with concerns the economy could falter quicker than expected, and potentially without the assistance of the Fed given stubborn inflation. However, investors then shifted their attention back to the post GFC adage – good news is bad, and bad news is good. Effectively, the bad news of weaker economic data would provide the impetus for central bank rate cuts. Those rate cuts would then support equity markets so long as the economic backdrop didn’t turn too negative. That saw equity markets go on a tear until mid-July.

Markets grinded to halt in July – a confluence of events sent strong investor sentiment into a tailspin. There was a failed assassination attempt on former President Trump’s life whilst on the campaign trail. An inch to the right, and the now President-elect would be dead. The ramifications of which would likely have been very extreme, bordering on civil war. Technology stocks took a beating around the same time after an incredible run. Firstly, there was the concern of technology trade wars, which then flowed into quarterly US company earnings where extremely lofty technology multiples came under pressure as sky-high earnings expectations disappointed. To cap the period off, we then saw ructions in currency markets, with the Japanese Yen reversing course and surging against the US dollar. The movements saw a wall of money shift out of risk assets as investors and traders moved to cauterise growing losses on a popular trading strategy.

The weakness saw renewed optimism of central bank rate cuts, with traders betting the US Fed and other central banks would turn more aggressive in cutting rates. The result - a strong rally in bond prices (yields lower) which culminated in the long-awaited recovery from bonds following on from a disappointing 2022.

The US central bank did its best to keep investors on their toes. At the time, we weren’t sure if it was intentional or a potential policy misstep. Effectively, they provided clues that conditions were weakening enough to provide some rate relief but did their best to counter and douse any expectations of a significant rate-cutting program. Markets didn’t like the mixed messaging – equities trended sideways before falling as investors grew impatient as to when the US rate-cutting program might begin. Elsewhere, other central banks had already begun cutting rates, namely Canada, New Zealand, the UK and the European Union.

Investors grew more confident through September that the US Fed would deliver, and deliver they did, with an outsized 0.50% rate! This came after months of consternation that they may not be able to deliver any outsized program of rate relief as the Fed tried to keep expectations in check and keep a lid on the exuberance festering in markets. The complicating factor remained profligate US government spending which kept labour markets tight and inflation sticky.

The outsized US rate cut saw investors’ addiction grow with rising expectations that the Fed would deliver another 0.50% rate cut at their next meeting, along with another one to two smaller cuts before the year was out. Around the same time, the Chinese government finally folded and delivered a surprisingly large stimulus package that foreign investors had been rather desperately awaiting. The announcement saw Chinese equities rocket higher off a very low base, helping lift sentiment on investing in the Asian and emerging market region. Unusually, the stimulus announcement was larger than expected, smaller than required, and very short on details. The short-term optimism quickly subsided as investors demanded more detail and actual stimulus, rather than rhetoric.

Investors saw reason to pause leading into the US election with polling and news flow firming on a Trump victory but with mixed views on the likely makeup of the Congress and Senate. The result, a clean sweep (Congress, Senate, Presidency, and popular vote), saw markets rally yet again, with renewed optimism supported by likely tax cuts and deregulation. Somewhat amusingly given the brief nature of market weakness, investors then remembered the year was nigh and that the 1.5-2.0% of expected US rate cuts that commenced the strong rally early in the year wouldn’t be delivered…. significant, but rather trivial when momentum is powering markets. The US Fed snuck in a smaller rate cut before year end, as expected, but revised down their forecasts for rate cuts in 2025 and significantly revised up their end of 2025 inflation projection.

Closer to home, economic growth continued to languish, labour markets remained incredibly tight with the public sector continuing to crowd out the private sector, headline inflation made some reasonable inroads but the RBA’s preferred measure remains stuck above their target range, the RBA sat on their hands for the year with no movements in the cash rate, productivity continued to fall, whilst the government eked out a small budget surplus on the back of all-time high tax revenue. With the slowdown in China and the surging US dollar, the Australian dollar finished the year weaker, languishing in the low 60s.

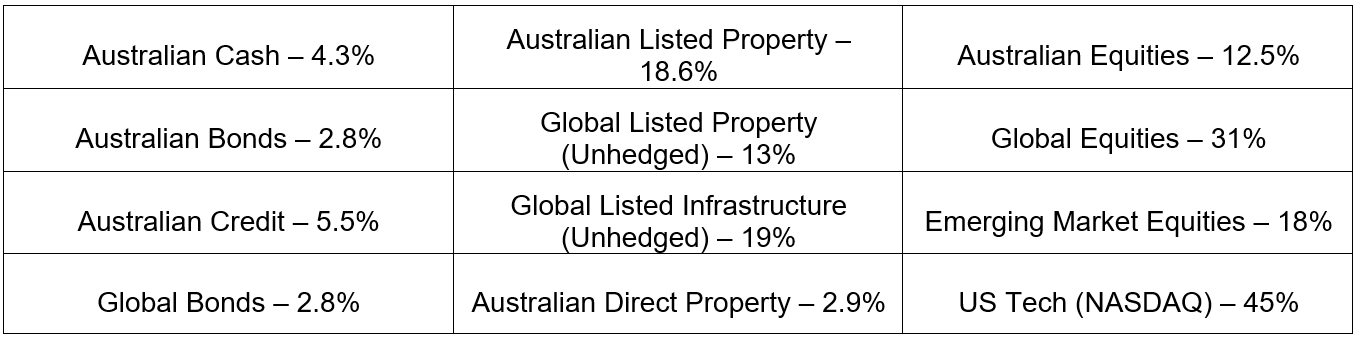

An interesting year to say the least, with investors ducking and weaving to uncover any piece of good news to help sustain the strong and narrow momentum rally. With returns as follows (at time of writing), we doubt anyone’s complaining:

Source: Morningstar

Outlook

Even the most ardent traditional economist disappointingly sees no immediate end in sight to the current regime of unorthodox government and central bank policy. This makes for a continued lively period of both risk and opportunity, where rules of thumb and historical precedent can’t be applied.

We think a confluence of factors will make 2025 one of the most fascinating years on record: a new US administration; Trump’s tariffs; the inflation battle far from over; how much relief can central banks provide; possibly more Chinese stimulus; equity market dynamics (i.e. does the narrow rally collapse or broaden); bond market dynamics (i.e. surging government debt, profligate government spending); and an unassailable US dollar with US government debt fast approach US$40 trillion.

All can and will have an impact on portfolio outcomes. Whilst key tenets of investing remain (patience, focus, calm, diversification, flexibility), areas of focus for 2025 include:

- Government debt levels and deficits

- Central bank rate paths

- Inflation reacceleration or stagnation

- Economic outcomes - soft landing or delayed harder landing

- Potential equity earnings disappointment

- Bond markets struggling for direction

- Potential US economic renaissance

- Impact of US tariffs

- Hopeful subsiding of geopolitical tensions

Whilst continuing to participate in markets, which is prudent at this juncture, we remain somewhat cautious in our approach, given lofty expectations and economic outcomes too heavily reliant on continued government largesse.

As always, if you have any questions or your personal circumstances have changed please do not hesitate to contact your financial adviser.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.