29 Apr 2025

Article written by PSK Investment & Research team

With the return of Donald Trump to the Oval Office, many of his policies have dominated headlines but none more so than his tariffs placed on countries globally, aimed at repairing United States trade deficits. In this update, we will look at what tariffs are, how they have been used historically and then explore Trump’s personal views on tariffs, his policies and ultimately what potential impacts on markets these may have.

What is a tariff and what purpose do they serve?

A tariff is a tax imposed on foreign-made goods, paid by the importing business to its home country’s government. The most common kind of tariff is levied as a percentage of the value of the imports, for example, a 25% tariff on steel imports. Most tariffs are designed as a way to restrict imports, by raising the prices of goods and services purchased from another country, making them less attractive to domestic consumers. Governments generally impose tariffs for one of four reasons. They are:

- To raise revenues - tariffs can be used to raise revenues for governments. This kind of tariff is called a revenue tariff and is not designed to restrict imports, but instead as a way to rebalance the trade deficit.

- To protect domestic industries - governments can use tariffs to benefit particular industries, often in an attempt to protect companies and jobs. An example of this would be the US tariffing Steel and Aluminium imports in a bid to protect their domestic industries.

- To protect domestic consumers – by making foreign-produced goods more expensive, tariffs can make domestically produced alternatives seem more attractive. Products made in countries with fewer regulations can harm consumers, such as containing toxic ingredients. Tariffs can be used to make these products too expensive for consumers to purchase.

- To protect national interests – tariffs can be used as an extension of foreign policy as their imposition on a trading partner’s main exports may be used to exert economic leverage. For example, when Russia invaded Ukraine, much of the world protested by boycotting Russian goods or imposing sanctions. Tariffs were placed on the goods not prohibited.

The implementation of tariffs can sometimes have unintended side effects, ranging from making domestic industries less efficient and innovative due to reducing competition, to hurting domestic consumers by driving prices up and in turn stoking inflation. The implementation of tariffs also has the potential to devolve into a trade war, an unproductive cycle of retaliation.

Tariffs throughout history

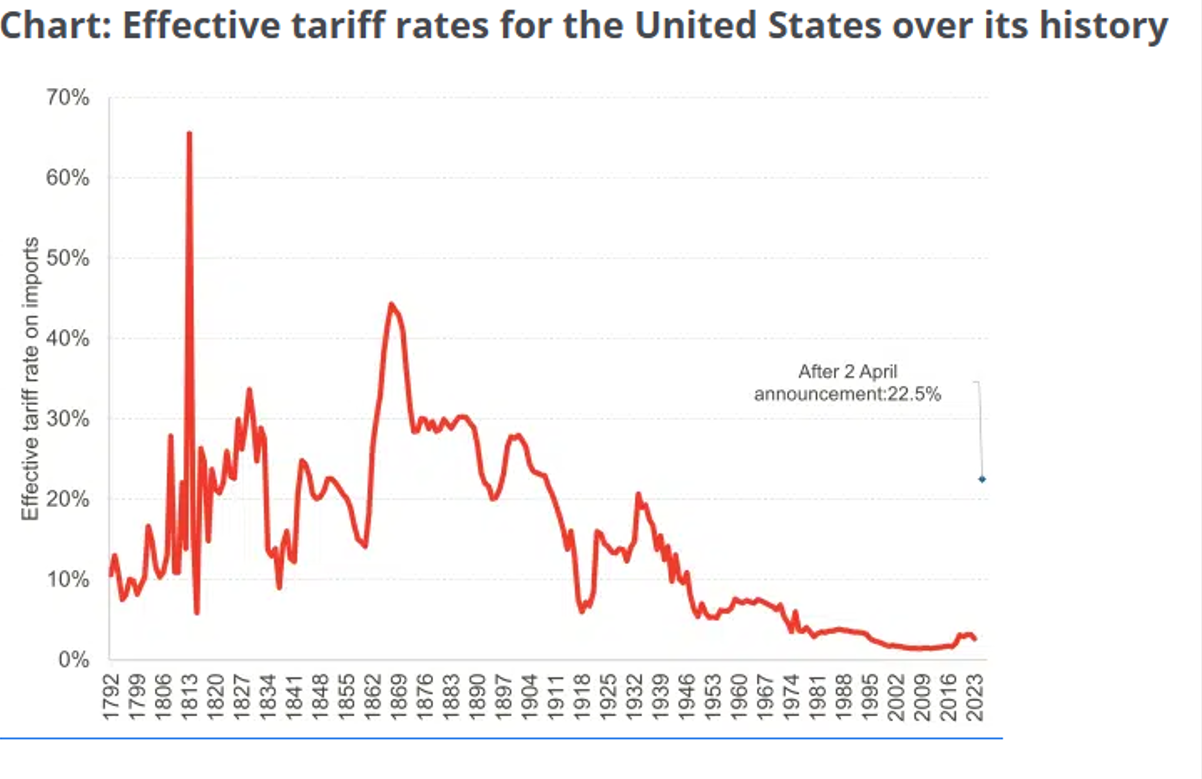

Tariffs were first used in ancient Greece and Rome to raise revenue for the government. In medieval Europe, tariffs evolved into tools to protect local industries. Throughout the 19th century, tariffs were a central feature of economic policy across the industrialising world, protecting emerging domestic industries and generating government revenue. In the early 1900s, tariffs lost their lustre as countries adopted income tax in the wake of tremendous industrial expansion. Protectionist measures were re-introduced by the U.S. via the Smoot-Hawley Tariff Act in response to the 1929 Great Depression. This Act unfortunately triggered trade wars which worsened the Depression.

Following the conclusion of World War II and the creation of the General Agreement on Tariffs and Trade in 1947, a new era in global trade was born. Countries rallied to reduce trade barriers and promote free trade globally, paving the way for the World Trade Organisation to be established in 1995. Most argued free trade was a net positive, allowing countries to specialise in economic activities in which they held competitive advantages.

Source: US Bureau of the Census, US Bureau of Economic Analysis, Yale Budget Lab, FAI analysis

Trump’s Take on Tariffs

Donald Trump has held a consistent protectionist view on tariffs for over 40 years dating back to the 1980’s believing other countries were ripping off the United States. Most of his ire at the time was directed at Japan, whom he believed were dumping products into the US, destroying domestic competitors. His focus has since pivoted towards China.

It was of little surprise that when Trump was elected President for the first time in 2016, he delivered on a key policy proposal - renegotiating trade agreements for the United States. His campaign had focused on putting America first and bringing about fair, bilateral trade deals that would bring jobs and industries back to American shores. When he took office, he signed new trade deals with Canada and Mexico benefiting US industries, he pulled out of existing trade partnerships that he believed undermined the US economy, and placed tariffs on solar panels, washing machines, steel and aluminium to protect domestic industries. He also imposed tariffs on China due to Chinese theft of US intellectual property and believed tariffs would make the US much stronger and much richer. China retaliated, resulting in a trade war between two of the largest economies.

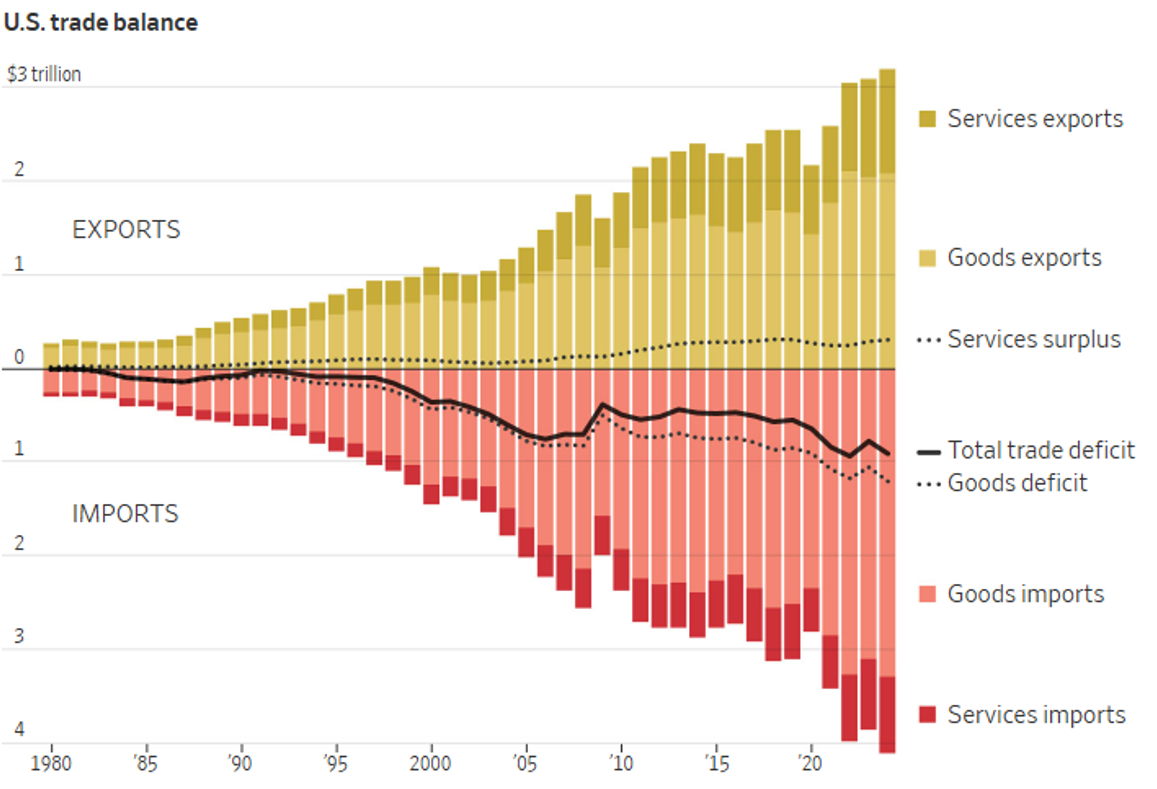

Trump won a second term late last year on a campaign committed to securing the border, containing growing trade deficits, and decreasing cost of living and US debt. On his first day as President, he signed the America First Trade Policy Presidential Memorandum, directing his administration to investigate the cause of the US’s large and persistent annual trade deficits in goods. Trump stated these large and persistent deficits led to the hollowing out of the manufacturing industry, inhibited their ability to scale advanced domestic manufacturing, undermined critical supply chains and rendered the US’s defence industrial base dependent on foreign adversaries. He believes the deficits have been caused in substantial part by a lack of reciprocity in trade agreements, evident in tariff rates and non-tariff barriers placed on US manufacturers. Some examples of these tariffs and non-tariff barriers are:

- Passenger vehicle imports where the US had a 2.5% tariff, compared to India’s 70%, China’s 15% and the European Union’s 10%,

- Ethanol imports have a 2.5% tariff in the US, compared with 18% in Brazil and 30% in Indonesia,

- Rice imports have a 2.7% tariff in the US, compared with 80% in India, 40% in Malaysia and 31% in Turkey,

- Broader import barriers and licensing restrictions,

- Sanitary and phytosanitary measures that unnecessarily restrict trade without furthering safety objectives.

Source: Commerce Department

Trump used tariffs in his first term to negotiate better deals for the US, evident with new agreements with Canada and Mexico. Trump intends to do the same again in his second term. He is using tariffs to force other countries to the negotiating table to talk trade and other issues that the current administration believes threaten the safety of the US, like the smuggling of fentanyl and mass illegal immigration, and asking countries to work with him on tackling these issues. This tactic was reasonably effective in his first term, and we wait to see what the outcome is this second time round.

Impact on Portfolios

International markets have reacted negatively once again to Trump’s tariffs, especially so to the ‘Liberation Day’ tariffs – reciprocal tariffs aimed at levelling the playing field with friend and foe alike. Markets tend to overreact to news without fully understanding implications or concepts. The S&P 500 fell more than 10% in the three days following the announcement, whilst the ASX 200 fell over 6%. Investors have been trying to price in tariff news on an almost daily basis, particularly since April 2. Most recently, Trump offered a reprieve in delaying the reciprocal tariffs on all countries bar China, allowing his administration time to negotiate deals with 60+ countries, and giving markets a moment to breathe.

Perversely, sometimes some good comes from fear and panic in markets. Some of the market focus has shifted from momentum (in 2024) back into company fundamentals and valuations which is pleasing to see. The risk of the US falling into recession in the short term and the implications of this to global growth remains a distinct possibility. For now, volatility has abated somewhat but remains elevated. Uncertainty remains and a cautious approach is well advised. A well-diversified portfolio, a long-term focus, and a portfolio setting matched to your risk tolerance are key to dealing with volatility and uncertainty within markets.

To discuss the impact of the above information on your portfolio, please contact your Adviser or call us on (02) 8365 8300.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.