25 Feb 2025

.jpg)

Article written by PSK Investment & Research team

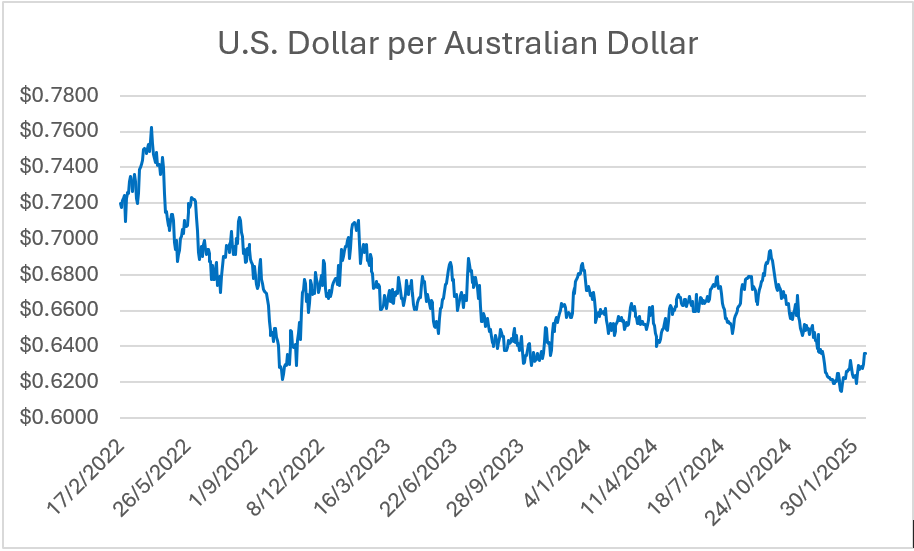

Many Australians travelling overseas would be acutely aware of the current value of the Australian Dollar (AUD). The AUD has stayed below $0.70 per US Dollar (USD) since late 2023, and below $0.80 per USD since 2018. As an economy heavily reliant on exports, particularly commodities, the AUD’s value is highly sensitive to fluctuations in global trade dynamics and market sentiment. In this piece, we will explore the key drivers behind currency movements, focusing on how commodity prices, central bank policies, and global risk sentiment specifically shape the outlook for the currency and the Australian Dollar.

What causes currency movements?

Currency prices are highly volatile and move around daily. The factors causing changes in currency pricing can be economic, political or market based. Some of these factors include:

- Interest rates – higher interest rates attract foreign capital and investment, which increases demand for the local currency, increasing its value. Low interest rates can also work against a currency, as investors may borrow in currencies with a low interest rate, and then invest offshore in currencies with a higher interest rate.

- Economic indicators – strong economic data can increase confidence in a country and therefore its currency, leading to higher demand for the currency and higher values.

- Political stability – countries with stable governments tend to attract more foreign investment. Political instability can cause investors to pull out of a country, which reduces demand for a currency and therefore its value.

- Inflation – low inflation generally strengthens a currency because it suggests that the purchasing power of that currency is stable. The impact of low inflation is complicated to predict as low inflation generally coincides with low interest rates, which weakens the local currency.

- Trade balances (exports vs imports) – when a country exports more than it imports, there is greater demand for its currency to pay for those goods. This can lead to currency appreciation. A trade deficit (where imports exceed exports) can have the opposite effect. Commodity prices also play a significant role in trade balances and therefore have impacts on currency movement.

- Foreign Direct Investment – investment from foreign entities in a country's businesses, infrastructure, or real estate can lead to increased demand for the local currency, which can cause appreciation.

- Market sentiment – public perception and investor sentiment can drive currency movements. Positive sentiment towards a country or its economic prospects can result in currency appreciation, while negative sentiment can lead to depreciation. When global risks rise, investors often look to “safe-haven” currencies such as the US Dollar and Swiss-Franc.

Source: PSK Private Wealth, FactSet

What has driven the fall in the AUD?

- Commodity Prices:

- Australia is a major exporter of commodities, including iron ore, coal, gold, and natural gas. Therefore, fluctuations in the prices of these commodities have a significant impact on the value of the AUD. When commodity prices rise, it boosts Australia's export revenue and generally leads to an appreciation of the AUD. Conversely, when commodity prices fall, the AUD often weakens. Commodity prices have been weak over the past few years, while China (our largest export partner) has faced a weaker economy and lower demand for Australian commodities.

- Interest Rates (Central Bank Policy):

- The Reserve Bank of Australia (RBA) plays a central role in influencing the AUD through its decisions on interest rates. The RBA did not raise interest rates as high as global peers, which led to less investor demand for the AUD.

- Global Risk Sentiment (Risk Appetite):

- The AUD is often considered a "risk-sensitive" currency because Australia’s economy is closely tied to global growth, especially in Asia. In times of global economic optimism or risk-on sentiment, investors tend to favour currencies like the AUD, which is seen as a higher-yielding, more volatile currency. However, in times of market uncertainty or risk-off sentiment, investors may flock to "safe-haven" currencies, which can lead to a decline in the AUD's value. Although share markets have performed well over the past 3 years, there has been significant uncertainty about global economic strength, which has led to investors buying the USD over other currencies, including the AUD.

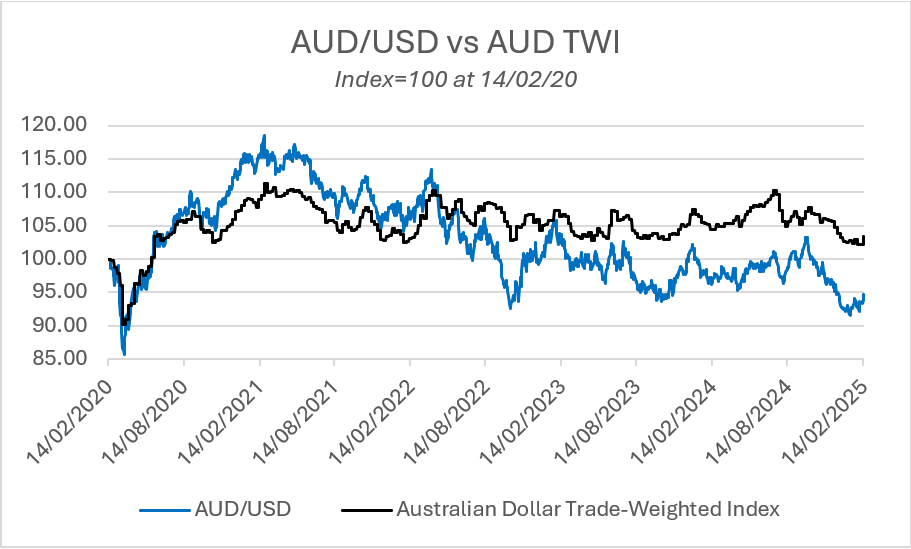

The RBA produces an AUD Trade Weighted Index (TWI) that allows us to compare the AUD to a basket of currencies, rather than just the USD. Using this measure, as shown in the chart below, we can see that the AUD has maintained its value against a broad basket of currencies since mid-2022 (black line) rather than falling as headlines often indicate. The blue line shows how the AUD has declined relative to the USD (the most reported measure of AUD strength). This demonstrates that most of the decline in the AUD/USD exchange rate has been due to a much stronger USD rather than a weaker AUD.

Source: PSK Private Wealth, FactSet

US Dollar strength has been driven by several factors:

- Strong growth expectations for US based companies, including large tech companies attracting large volumes of global investment

- Very strong economy relative to global peers

- High interest rates

- Global risk sentiment – perception of the US Dollar as a safe haven currency during periods of economic weakness in China and most of Europe

What’s the impact of a lower AUD?

Economic Impact

A low Australian Dollar makes it cheaper for offshore investors and companies to buy Australian assets and exports, including our commodities. This is positive for our export-facing industries. At the same time, the low AUD makes it more expensive for Australians to import goods from overseas, which risks increasing inflation.

Portfolio Impact

When the AUD falls, Australians' overseas investments become more valuable. This is because when the invested capital is brought back to Australia, it is converted at a more favourable exchange rate. Over the past 5 years, this has benefited investors as the AUD has declined. This gain happens when the investment is not protected against exchange rate fluctuations (unhedged).

When an investment is hedged, the currency impact is minimised or removed entirely. Most defensive exposures (cash and bonds) are hedged, while most growth exposures (stocks, property and infrastructure) are unhedged.

There are significant diversification benefits of unhedged investments, which include exposure to a broader range of currencies as well as providing protection as the AUD generally falls during market downturns. Hedging concentrates currency exposure on just the AUD.

The Investment & Research team at PSK are always monitoring market conditions and data points to ensure portfolios align with our overall long-term objectives. If you’d like to discuss any of the points raised, please contact your Adviser or call us on (02) 8365 8300.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.