23 Sep 2024

.jpg)

Article written by the PSK Investment & Research team

This month, we look at ways to best manage your portfolio when share-markets come under pressure and drawdowns become apparent.

Revisiting a long-held adage of investing that still holds: “success is achieved through time in the market, not timing the market”.

Investment cycles and cyclical fluctuations are a key aspect of investment markets. Most are driven by economic developments and/or government policy but are often magnified by swings in investor sentiment be it pessimism or optimism.

Investment cycles are different and usually no two are the same, although similarities do exist. They range in duration as well.

Long-term or secular cycles, go through numerous bull (up) and bear (down) markets and usually last multiple decades. Medium-term cycles, like the business cycle is the one most people are familiar with. It generally has a duration of 3-5 years, and it tends to relate to the standard economic cycle where after a few years of economic expansion, inflation or other imbalances build up, which then results in changes to central bank policy. These changes often lead to a weakening economic environment or recession, with falling inflation and central bank relief, which then sets the scene for the recovery and potential next expansion. The final shorter-term cycle is usually the most uncomfortable one for investors and is generally driven by extreme swings in sentiment. These short-term swings lead to higher levels of volatility and severe movement in not only equity markets but bond and currency markets.

Predicting or timing investment cycles is never easy and positioning an investment portfolio to mitigate the risk of short-term cycles is largely a futile exercise. Although numerous economic and market indicators are observed and studied, no two cycles are the same. While the awareness and understanding of cycles is more important, the best course of action is generally to take a long-term approach to investing, looking through these cycles, while reviewing and sticking to your plan.

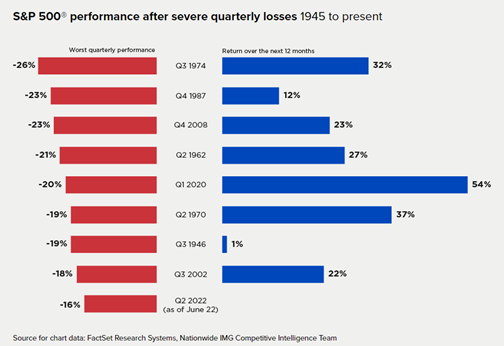

You may however wonder during this time, how much with will my portfolio value fall by? As the chart below illustrates, the second quarter of 2022 may be the ninth-worst quarter for the S&P 500 Index since World War II. However, in the 12-month periods following down quarters in the past, the benchmark stock index, in this case, the S&P 500, rose by an average of 26%. This illustrates why investors should ignore short-term market noise and stay focused on their long-term investment strategy.

Note that since Q2 2022, to June 2024, the S&P 500 has returned circa: 41% (in USD terms).

There are several key points to consider as markets become jittery, and a downturn begins. Again, we cannot predict a “specific” cycle, and it is quite natural to grow uneasy as a down market begins, but we can prepare and manage investment portfolios to try and be “all weather” to help navigate through cycles and more importantly downturns, as best we can.

Knowing your comfort zone when it comes to taking risk is one of the first parts of the overall process. It is part of your initial roadmap which would also consider your investment timeframe. Your risk tolerance is a balancing act between the size of portfolio falls you can tolerate and your return requirements. Your investment timeframe can also help guide the level of risk taken in a portfolio given longer timeframes afford more time for portfolios to recover following a fall. With a long-term plan in place, it is imperative for the health and success of an investment portfolio not to get caught up in short-term noise or cyclical swings.

It is best to remain calm, maintain your long-term perspective, and rely on your adviser for guidance. As markets fall, it can be tempting to sell investments in a panic (usually at deeply discounted prices), and/or keep your money on the sidelines as you wait for markets to stabilise or recover. Trying to time market entries and exits, (refer to Investment Note – June 2024), is a “fool’s errand” and such decisions usually significantly impair portfolio outcomes via missed returns, tax, and transaction costs. Avoid knee-jerk or emotionally charged reactions.

Continuing to invest during falling markets. This is sometimes known as dollar-cost averaging; an effective strategy, often being able to buy more with the same or less amount of money as before and in turn smoothing out return profiles over the longer-term. Critical to riding out falling markets is the ability to participate in the rebound.

Review asset allocation and diversification. Asset allocation and portfolio diversification continue to remain key elements in riding out market downturns. This is because different assets have different risk and return drivers at different points in a cycle. Whilst concentration or placing all your eggs in the one basket can boost returns in good times, it also has the effect of magnifying portfolio falls which can elicit emotional and often poor decision-making. As mentioned, different assets perform differently within different cycles, so the key is to have a mix of investments blended in a well-balanced portfolio to provide a smoother ride over the long-term. Asset allocation becomes your risk mitigator during market falls and periods of increased volatility. Sudden and/or significant changes to your asset allocation are never ideal. Instead, it is best to slowly evolve your asset allocation and investment diversification when markets aren’t particularly volatile, whilst taking advantage of portfolio rebalancing.

Markets exhibit plenty of inefficiencies largely due to investor behavioural biases. Being well prepared and having a personalised and sensible long-term plan will certainly help in navigating through the many cycles that will be experienced. PSK’s investment philosophy is built around a robust and pragmatic asset allocation framework, with a sensible degree of flexibility, which can be used where and when appropriate. A well-diversified portfolio will assist in mitigating market risk as well as limiting unintended portfolio biases, either style, asset class or region. This, along with other strategies such as remaining invested (calm), investing through the cycle (taking advantage of market falls), seeking guidance from your adviser, will assist in maximising risk-adjusted returns and better enable you to meet your objectives.

As always, if you have any questions or your personal circumstances have changed please do not hesitate to contact your financial adviser

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.