28 Jul 2016

It’s fair to say the world has been a fairly interesting and confusing place over the past few months. The comments below aim to simplify many of the recent happenings and events, in order to provide greater clarity and direction as to our current thinking and potentially your portfolio positioning.

Australia

Politics

The election result was finally settled with the Coalition just forming government. They will be further assisted by some of the minority party’s when it comes to support on the floor of parliament, which will help given the skinny majority the Coalition has. The upper house (the senate) is a different beast altogether, with plenty of seats now held by the Greens and other independent parties. The implications are as follows:

- The Coalition has to get very good at negotiating very quickly (something they have been poor at for some time)

- Everyone acts like adults, behaves, and passes legislation quickly and efficiently where it is in the best interests of the majority of the population (hopeful, but highly unlikely).

- Nothing gets done for the next few years, in the absence of points 1 and 2 (highly possible given the last couple of governments).

On that basis, the credit rating agencies have already put Australia on negative credit watch with a likely downgrade to our credit rating over the next year or so. The economy could do with a productive fiscal boost (government investment and tax reform) to assist the RBA in their efforts.

Economic outlook

The economy continues to transition away from the mining boom. The construction boom has filled the void, but that too has likely hit its peak, and will begin to slow over the next couple of years. In the absence of another boom in another sector, the Australia economy will continue to slow. At present, unemployment looks reasonable, inflation is below the RBAs target, wages aren't rising and probably won’t for some time, and the Aussie dollar is too high for a transitioning economy. Thus, the RBA is likely to lower the cash rate 1-2 more times this year to put downward pressure on the dollar and to attempt to address falling inflation. If the dollar does fall, it will provide support to other sectors of the economy (i.e. tourism, healthcare, financial services, education, etc).

Market

Australian government bonds look somewhat attractive given the expectation for a declining cash rate. The flip side is not good for savers and retirees. The declining cash rate and expected falling bond yields will likely lead to upward pressure on property and equities. However, neither of these asset classes look cheap at present with already high dividend payout ratios, lacklustre earnings, and valuations above long term averages.

US

Politics

Donald Trump has been confirmed as the Republican presidential nominee. The race is now on to the White House. Both trump and Clinton have indicated they a likely to stimulate the economy through increased spending, but both have very different approaches. Nevertheless, the makeup and power in the houses of parliament remain the most important factor in relation to US policy and the outlook on the economy.

Economic outlook

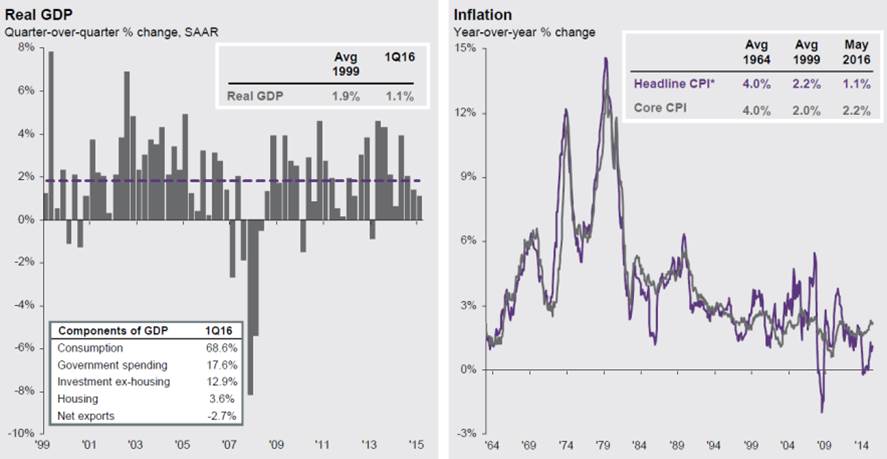

The US economy is doing very well. Unemployment is at all-time lows, core inflation is pushing higher assisted be reasonable wages growth, and the housing sector is strengthening. The US dollar rising strongly from here is the biggest impediment to the US economy continuing to grow, hence why the Fed has been very slow to raise rates. Given economic data and conditions, the Fed funds rate should be a lot higher than it currently is. The Fed has been deliberately slow, wanting to stoke inflation higher than usual neutral levels, constrain the US dollar from rising too strongly too quickly, and also be more globally aware in relation to the effects of higher US interest rates on global markets. The Fed should raise rates at least once this, maybe twice.

Market

The US dollar and US treasuries (government bonds) remain safe haven assets for the rest of the world. Hence, risk-off periods will put upward pressure on the US dollar and downward pressure on us government bond yields (ie. higher prices). US equities look expensive, but given the positive economic back drop, very low interest rates, and a plethora of very large multi-national companies listed in the US, there are plenty of reasons to justify current high valuation levels.

Europe

Politics

Really looks a mess. Brexit has yet to be ratified by the UK parliament and they have not yet issued their intention to leave the EU. Though, they do have a new PM, which occurred quicker than most expected. Brexit will be a long drawn out process with markets hoping for a reasonably smooth exit, which is in both party’s interests, but rationality does not always prevail. There are plenty of potential headwinds and self-interest to overcome.

Spain is still unable to form government after their second federal election in 7 months. Italian banks are in trouble with too many non-performing loans and a government which is struggling to retain power with the rise of the anti-EU parties. They will likely have a referendum on proposed constitutional changes. If they fail to succeed, the government will likely be spilled with new early elections called. The French political landscape also looks troublesome.

Economic outlook

Economic data has actually stabilized of late. Unemployment continues to fall, economic growth remains anaemic but positive, and inflation has stopped falling. This has largely all been the work of the European Central Bank which has back-stopped markets more broadly and in specific risk-off events with even more stimulus and increased liquidity, and promises for more of both if required. This will buy the EU sometime to get policies and fiscal management on track to support economic growth and to support consumer, investor, and business sentiment and confidence. At this point in time, it’s difficult to predict whether Britain will fall into recession given uncertainties regarding their exit from the EU, but the probability of recession remains heightened.

Market

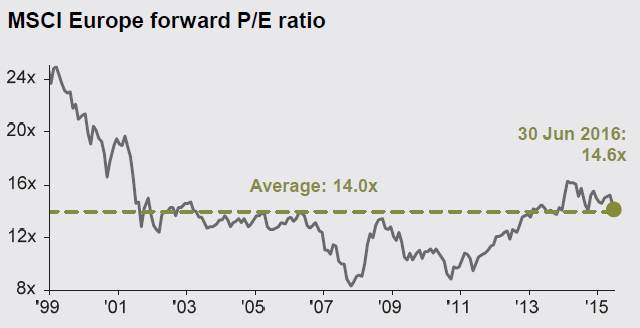

European equities look good value on a relative basis. But on an absolute basis, are about fair value at present. European cash rates are now negative and many European bonds, some out to 30yrs and more, are now carrying negative yields such is the pressure on the “return of capital” rather than the “return on capital”. We think they look extremely expensive.

Asia

Politics

Political news in Asia tends to be dominated by Japan and China for obvious reasons. The recent Japanese upper house elections increased Prime Minister Abe's power. He now looks likely to embark on a massive stimulus program, but we've seen promises and recycled policies like this before.

Chinese authorities continue to embark on their multi-year plans of liberalising their market structures and moving towards a more western/capitalist model for equities, bonds, and currency, whilst trying to eliminate corruption within the political and defence force ranks.

Economic outlook

The Japanese economy continues to look a mess. Whilst unemployment remains very low, this is really a function of draconian labour laws. Inflation is falling yet again and the government has baulked at raising the GST. Reforms are needed, more so than ever before. Their extraordinary central bank policy is really about sterilising the government’s sky high debt levels and trying to keep a lid on the currency rising further (the latter attempt has failed). Hopefully the potential stimulus is followed up with real economic reforms.

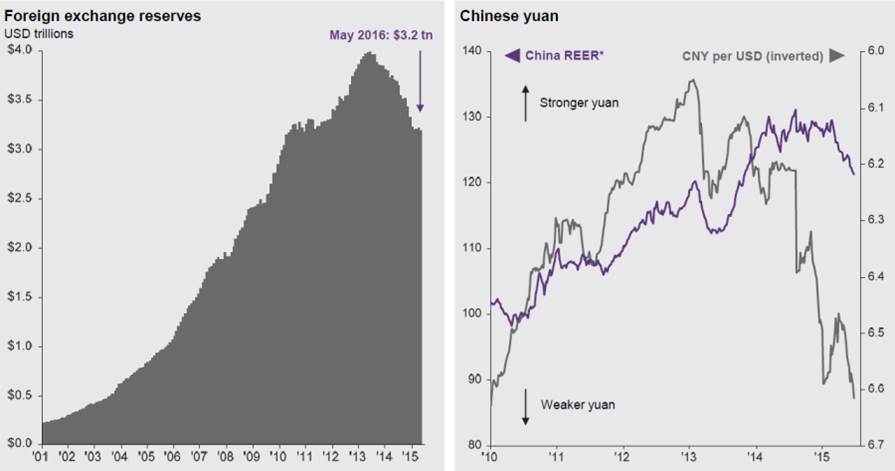

As widely known, China has a corporate debt problem given the significant rise in corporate debt over the last 5-10 years with plenty of zombie corporations which are supported by the government. Whilst this presents a risk and likely results in some defaults, the Chinese government has more than 3.2trn in foreign exchange reserves which can be used to support the economy if needed. They will likely strike a balance between saving some firms and letting others collapse in order to ensure the experience of some pain is felt to assist in setting the right corporate behaviours going forward. The property sector has stabilized of late and they will continue to let their currency devaluing at a slow and steady pace so that it moves more towards its fair value.

Market

Japanese and Chinese equities have performed poorly of late. Chinese currency continues to fall whilst the Yen has upward pressure. Japanese bond yields continue to fall given the central banks policies. The Chinese bond market is largely closed outside of China but China's relatively high cash rate provides reasonably solid real yields. Chinese equities look attractive on valuation grounds whilst Japanese equities don't look that attractive on a relative basis.

Emerging Markets

Politics

Emerging market politics are usually always in the headlines in some way, shape, or form. More recently we've had the corruption scandal in Brazil, a failed coup in Turkey, and the ever-present risks regarding Vladimir Putin's global strategy. Gladly, the political environment has been stable and strong in India, which is reflective in the strength of the economy.

Economy outlook

The economic outlook is improving for emerging markets, though it remains very different from country to country. Mexico and India look really good, Brazil could turn positive relatively quickly if they are able to clean up government and get moving with reforms, whilst Russia continues to go backwards. Emerging markets are generally negatively affected by rises in the US dollar and commodity prices, both have of which have been stagnant of late, thus provide some support to their economies.

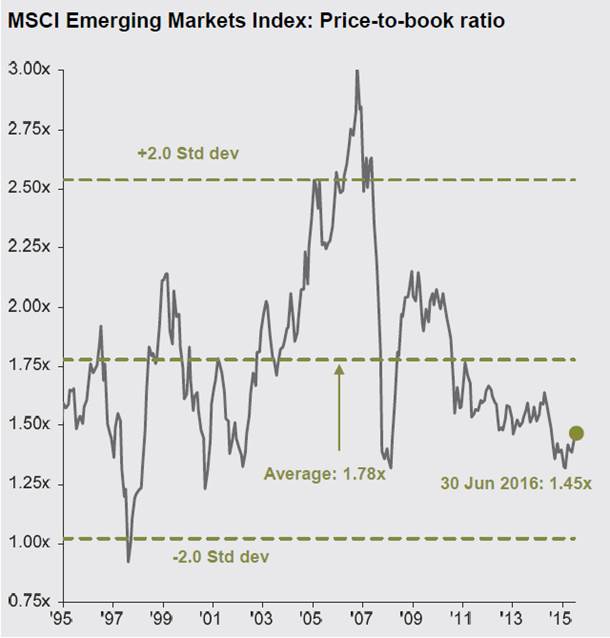

Market

Performance has varied widely from country to country and will continue to do so. Equities have rallied of late given the stabilisation and rise in commodity prices, but equity returns have been very poor for some time. Bonds are very high yielding given higher levels of inflation and higher cash rates in many of these countries. We would expect these cash rates to come down as inflation falls. Equities by and large look good value versus historical averages and relative to other equity markets. However, currency risk remains a big concern for foreign investors in emerging markets.