23 Dec 2014

What’s been causing all the grief?

Commodity prices have been in free fall and the local economy has been struggling, coupled by a sharemarket which looks like finishing flat for the year. Further, we have the US steaming ahead leaving everyone else behind, China slowing but finding a way through the trees, Europe stagnating with their own form of quantitative easing (money printing) on the way, and Japan preparing (early elections) to fire the final arrow of their three arrow repertoire.

Below is the first part of a two part update on these key issues.

Commodity prices in free fall

Brent crude oil closed at US$60 a barrel on 22 December. Looking back over 2014, oil sustained a price of approximately US$110 a barrel for the first half of this year, but has been on a fairly steady decline since the end of June. We saw a rapid drop in price following the OPEC (Organisation of the Petroleum Exporting Countries) meeting at the end of November when the Saudis refused to cut production in order to support the price of oil.

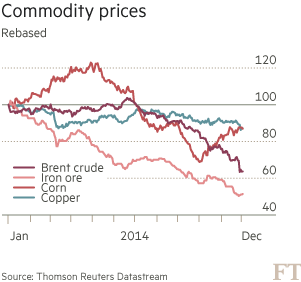

A combination of strong production and weak growth in demand has been putting downward pressure on oil prices. OPEC (mainly the Saudis, given their capacity to change supply rapidly with very low costs of extraction) were asked earlier in the year to increase production following concerns that the Russia/Ukraine conflict may escalate and result in a reduction in global supply given Russia’s vast reserves (which mainly supplies Europe). This coincided with falling global demand for oil given a slowing China and Europe, and US shale production growth exceeding expectations following plentiful funding and the speed at which a shale well can come online. The chart below illustrates the drop in commodity prices.

Historically, OPEC acted to reduce oil price volatility and help balance supply/demand in the oil market, however, this time appears to be different. OPEC does not want US growth to continue at such a rapid pace, as this would require OPEC to continue shrinking production in order to maintain prices. For a temporary period this would be fine, but in the long run such an outcome is not sustainable.

Consequently, Saudi Arabia is communicating a change in policy:

1. it won’t act to balance supply/demand unless all OPEC members act accordingly (i.e. the pain is shared);

2. oil prices at current levels can and will bring Russia and Iran to their knees (the Saudis aren’t happy with Russia and Iran’s involvement in the Syrian civil war; and

3. a reminder to the US shale industry and other high cost producers that the Saudis are still the biggest boys in town, and that only the most efficient producers should produce.

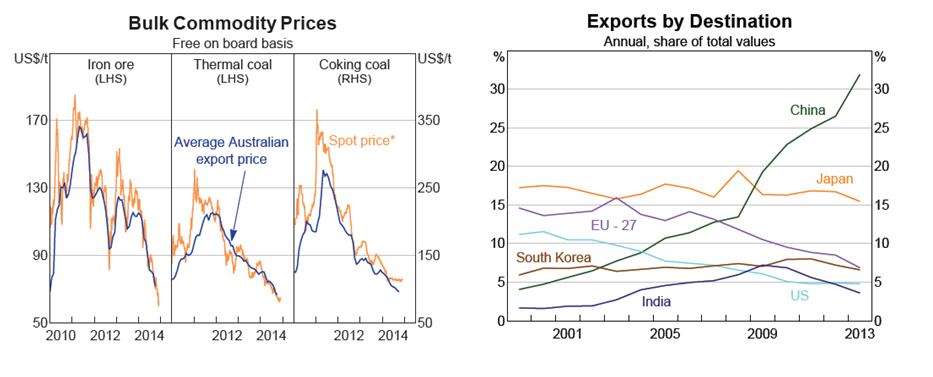

In addition, the iron ore price has fallen close to 50% this year. Similarly to the oil price, this drastic fall is a result of both demand (slowing China and Europe) and supply (increasing supply) forces. As discussed previously, BHP and RIO hatched their own very similar plans to:

1. flood the iron ore market with plentiful supply in order to flush out the highest cost producers;

2. continue to lower costs of production so that between the iron ore price falling and volume increasing, BHP and RIO are no worse off net; and

3. continue to cut capital expenditure and aggressively pay down debt to improve their balance sheets and potentially pay out much higher dividends in future.

Implications

Whilst the oil and iron ore prices can certainly remain at these levels for the next 6 to 12 months, we believe they will push higher as supply decreases and demand begins to pick again. We don’t think they will both be above US$100 any time soon, but certainly higher than current levels.

On the company and share price front, we believe that the likes of BHP and RIO have been sold down to very attractive levels, as per the major oil and gas producers in Australia (e.g. Origin, Santos, Woodside and Oil Search).

On the global growth front, lower oil prices are essentially a tax cut for the global economy and should support global growth. Russia and the US are probably the biggest losers (though the US is also a beneficiary of lower oil prices). We’ll talk more about the effects on Russia below, and the US will be covered in next month’s update.

Russia

Russia’s impact on the global economy has been diminishing over the last decade, which has more recently resulted in President Putin’s more aggressive stance on foreign policy matters (i.e. shoring up or ‘demanding’ unbridled support from ex-Soviet countries). Russia still supplies a considerable amount of energy into Europe with over half of the energy they supply running through Ukraine.

The fall in the oil price has the potential to cripple the Russian economy. Since 2012, the oil and gas sector accounted for 16% of the Russian economy, 52% of the federal budget’s revenues and over 70% of all exports. All three of these numbers probably have increased since 2012, making the Russian economy solely dependent on the oil and gas sector. Russian inflation is now out of control as the Rouble (currency) continues to fall.

The Russian central bank was forced to raise the cash rate from 10.5% to 17% overnight recently, following a rise only five days before. The interest rate rise did little to stem the decline in the Rouble. All of this comes in addition to the sanctions the US and Europe placed on Russia following the invasion of Ukraine, having significant effects on the Russian economy. Given the oil price is out of Putin’s control, the only thing he can control are Russia’s borders and foreign policy, which may lead to further aggression.

Implications

Unless you hold Russian equities through an emerging market exposure or Russian currency, then your portfolio is largely unaffected.

At this stage, the impact is limited to Russia, Russian bonds and equities, and the Rouble. But caution is needed regarding the potential for geopolitical risk and rising tensions between countries.

The Australian economy and share market

It’s fair to say the Australian economy is struggling in light of commodity price falls and the deteriorating federal budget balance, and there have been calls that the RBA will cut rates another two times in 2015. Although we might have recessionary conditions for 2015, for there to be a recession, we have to have two quarters of negative economic growth, a very low probability event given the data available at this point.

Relative to the rest of the world (excluding the US), our economy still looks in reasonable shape. We expect the Australian dollar to fall further, but it needs to start falling against other currencies (i.e. the Euro and the Yen) than just the US dollar for the economy to benefit.

We don’t expect the cash rate to fall further as the RBA is still concerned with stoking asset bubbles (namely property) and hopefully they won’t have to cut any further if the Australian dollar keeps falling. But the RBA has the ammunition and the room to cut rates further if they need to, which most of the world doesn’t have flexibility to do so (given they’re at 0% rates). The RBA will cut if they see a recession on the table, which is unlikely at this stage.

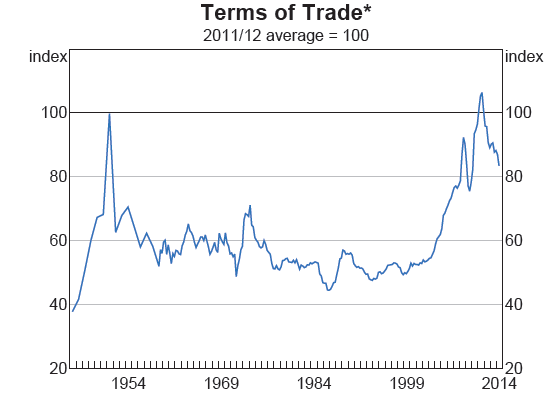

The biggest issue now is the government budget and what they are able to get passed over the next couple of years. The falling iron ore and oil prices have created an even bigger hole in the budget; we’ve just seen the biggest drop in the terms of trade (what we receive for our exports versus what we pay for imports) since records began in 1959 (see chart below). Falling commodity prices and lower wages growth have cost the federal budget $31.6bn in tax receipts in the last six months alone.

The government needs to simultaneously make cuts to welfare spending whilst boosting spending for measures that will add to the productive capacity of the economy. Tax reform is also desperately needed, but they are hamstrung by the minority parties. Unemployment will probably rise to 6.5% (maybe even 7%) over the next 6 to 12 months, and inflation and wage pressures will remain low.

This is not a supportive environment for equities, but economic growth and equity market performance are completely uncorrelated. Equities should still be well supported given low interest rates and low bond yields, although we shouldn’t be expecting 15-20% returns. What we should be expecting are returns in line with long-term forecast returns which are in the 7-10% range (5% dividend yield and 2-3% earnings growth).

The commodity boom is over and we now move into the export phase; Australia has plenty to export to the rest of the world (iron ore, coal, uranium and LNG), especially to our Asian neighbours (see below charts). Behind that, we don’t have much to move forward with to help support the economy. We could benefit from exporting financial services and agriculture, but we haven’t been able to get this right to date. If we can, then the economy can be well supported again from a more robust footing.

Implications

Investors could look to hold more global assets such as fixed interest, equities and property/infrastructure. Where global equities or property/infrastructure are held, an unhedged currency basis (where possible) and a well-diversified portfolio could be beneficial (the resources and financial sectors make up approximately 70% of the largest 200 companies on the ASX).

We expect global equities (on an unhedged currency basis) to be a more fertile opportunity set than Australian equities over the next couple of years, although Australian equities look reasonably attractive on a valuation basis relative to equity markets around the world.

The second part of this market update will be made available in January, covering the US economy, the slowdown in the Chinese economy, and stagnating Europe and rising political issues, and Japan.

If you wish to discuss any of the above, or your current situation/portfolio, please don’t hesitate to contact us on 02 9324 8888.