26 Oct 2022

2022-23 Federal Budget Update

October 2022 - Article provided by PSK's Chief Investment Officer Chris Lioutas.

The new Federal Labor government has handed down their first budget with an improved fiscal position for the current year, but with mounting challenges in the period ahead.

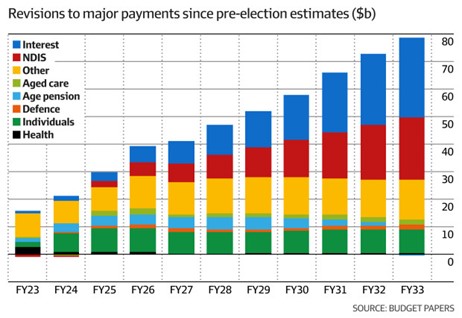

The Albanese government has warned of “hard days to come”, meaning the likelihood of tax increases and spending cuts in the period ahead with debt and deficit forecasts over the next decade now expected to be worse than thought just six months ago due to the out-of-control National Disability Insurance Scheme, rising debt payments, and weaker productivity.

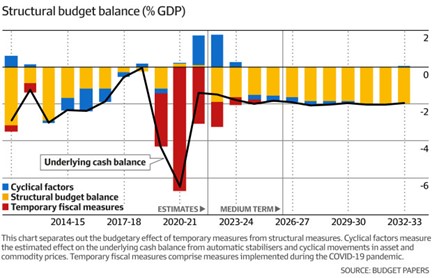

The improvement in the cash balance amounts to $42 billion in 2022-23 and the government now expects a further improvement of $12 billion in 2023-24, both compared to previous forecasts. The improvement came via soaring commodity prices (royalties) and a booming jobs market (tax revenue), both of which are unlikely to be repeated.

Budget deficits will continue through to 2032-33, but the government doesn’t expect them to exceed more than 2% of GDP from 2024-25.

The Treasurer all but abandoned Labor’s pre-election pledge to reduce power prices by $275 a year by 2025 but gave notice that the government was planning a broad range of regulatory interventions in the energy market. They refrained from using those interventions now to not add further inflationary pressures.

Overall, a reasonable budget in terms of what was required, but an uninspiring one with the forward period in mind.

Forecasts from budget papers included:

- RBA cash rate to peak at 3.35% in 1st half of 2023 (currently at 2.60%)

- Inflation to average 5.75% this financial year and 3.5% next year, before dropping back to 2.5% in 2024-25

- Unemployment to rise to 4.5% over the next 2 years

- National Disability Insurance Scheme could hit $102 billion by June 2023 which would see it eclipse the age pension

- Annual interest payments on government debt expected to hit $70.5 billion in the next decade, about $30.5 billion higher than forecast just 7 months ago

- Electricity costs to rise by 20% this year and another 30% next year, whilst gas costs are to rise 20% this year and another 20% next year

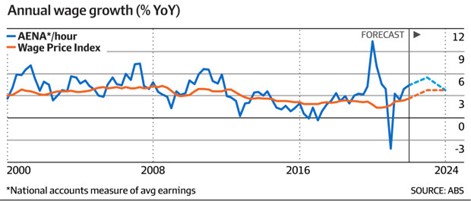

- Wages to grow at the fastest pace in more than decade at 4%, but workers to still be worse off with inflation running hotter wages growth

- Deficit to remain about $50 billion over the next decade, roughly 2% of GDP, with big cuts needed to bring the deficit in

- Gross debt to continue rising out to 2025-26 to $1.16 trillion or 43% of GDP, whilst net debt rises to $767 billion or 29% of GDP

Some of the winners and losers from the budget include:

Winners

Families – progress on $4.7 billion plan to reduce the cost of childcare for families from July 2023

Patients - $2.9 billion package to strengthen primary care

Aged care residents - $2.5 billion to mandate a minimum number of care minutes for nursing home residents and employing a registered nurse onsite 24/7 in homes.

Internet - $2.4 billion to be spent on NBN to expand full fibre access to 1.5 million homes and businesses by 2025

Foreign Aid - $2 billion boost in aid and grants for the Pacific and SE Asia.

Students - $852 million to provide 480,000 fee-free TAFE places

Medicine users – Max co-payment on prescription drugs drops to $30 a script from January at a cost of $787 million

New parents – $530 million for paid parental leave payments up to 26 weeks by 2026

Self-funded retirees – income thresholds increased to $90,000 for singles and $144,000 for couples so more people qualify for the senior’s health card.

Skilled migrants – permanent migration program expanded to 195,000 places a year

Losers

Scrapping previous grants – including infrastructure, business incentives, community programs, road and commuter car parks, etc, saving $13.7 billion

Consultants and external agencies - $3.6 billion in savings from reduced outsourcing by the public service.

Energy users – electricity costs to rise by 20% this year and another 30% next year, whilst gas costs are to rise 20% this year and another 20% next year

Consumers – weather related events on east coast to add to food inflation over the next few quarters

Multinational companies – crackdown on multinational tax avoidance to take in more than $950 million over 4 years

Investors – closing tax loophole for big companies and investors in off-market share buy-backs, raising $550 million

Foreign investors – fees doubled for applications in July and penalties for residential land breaches from January, expected to take in $457 million over 4 years

As always, if you have any questions or your personal circumstances have changed please do not hesitate to contact your financial adviser

PSK Financial Services Group Pty Ltd ABN 24 134 987 205 trading as PSK Private Wealth; is a Corporate Authorised Representative & Credit Representative of Charter Financial Planning Limited, ABN 35 002 976 294. This document contains information that is general in nature. It does not take into account theobjectives, financial situation or needs of any particular person. You need to consider you financial situation and needs before making any decisions based onthis information.