29 Nov 2016

Do you need critical illness insurance?

We all get sick sometimes – that’s life. But some of us will unfortunately experience serious illness. The cost of recovering from a condition like cancer or heart attack can take its toll not just emotionally, but financially, too.

How would you afford the cost of medical treatment? How would you cover your debts – including your mortgage – or be able to cope financially as you ease back in to work?

1. What is critical illness insurance?

Critical illness insurance pays an agreed lump sum benefit in the event of a listed serious illness. This money can help you survive financially while you focus on recovering and getting back to your everyday life.

2. What are the features?

Here are just some of the features you can expect with critical illness insurance:

- Cover for major Illness events: Cancers, heart disease and stroke are all typically covered.

- Choice of cover levels: You can choose between standard contract or premium contracts, which will provide cover for additional conditions.

- Additional benefits: For instance, Child’s Critical Illness insurance can provide you with an additional payment if your child suffers a critical illness event

3. The risks

- In 2010, an estimated 114,000 new cases of cancer were diagnosed in Australia.

- More than 60% of cancer patients will survive more than five years after diagnosis.

- Two out of every three people that suffer a first time stroke will be alive one year later.

- About 88% of stroke survivors live at home. Most of them live with a disability

4. The reality

- Australians are suffering an increasing incidence of cancer. In addition to this, we’re continuing to experience high levels of heart disease and stroke.

- Advances in medical science mean we now have a greater chance of surviving these conditions. But treatment can be drawn out and expensive - forcing patients to take months or even years of work.

- Still, many Australians don’t take out insurance protection because of some common misconceptions.

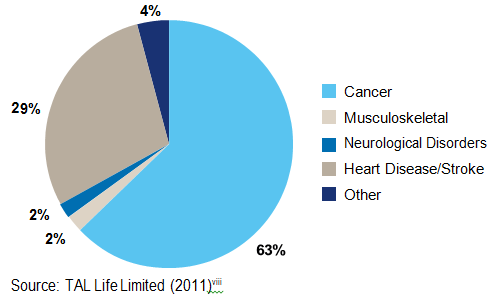

5. Causes of claim

How can I ensure I am protected?

Contact PSK today and find out how we can help you tailor the right level of cover for your needs.

For more information and to obtain a critical illness insurance quote, talk with your PSK Adviser click here to make an appointment.

Please contact us here if you would like the references for these articles.