7 Oct 2020

Federal Budget 2020-21: The biggest since World War II

By Chris Lioutas - PSK Chief Investment Officer

Last night, Treasurer Josh Frydenberg handed down the postponed and much anticipated 2020-21 Federal Budget in light of the Covid-19 pandemic. It is fair to say it lived up to expectations in terms of big numbers – i.e. big stimulus, big deficit, and big debt projections.

Some will say that a budget of these proportions and magnitude was unnecessary and avoidable if different health and policy paths were taken. That is the past. Given the current state of play and what we know of the period ahead, it’s impossible to argue that this level of stimulus isn’t required to kick-start the economic recovery and get us back to where we were pre-virus as soon as possible.

The budget certainly delivered in terms of stimulus –

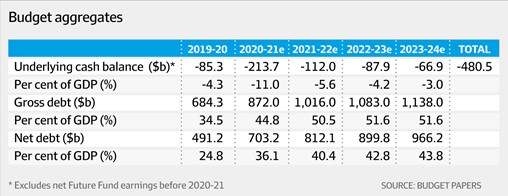

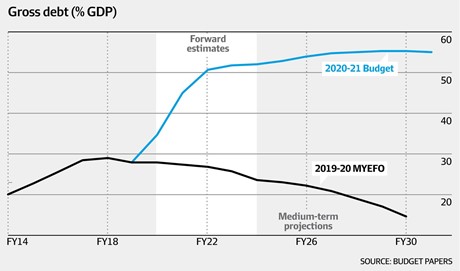

- $214 billion deficit

- 10 years of projected deficits with $480 billion in cumulative deficits out to 23/24 FY

- Debt to hit $872 billion this FY and move up to $1 trillion next FY

Key announcements included:

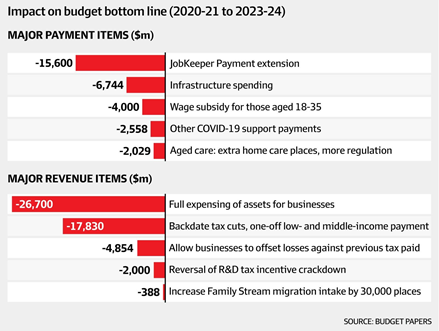

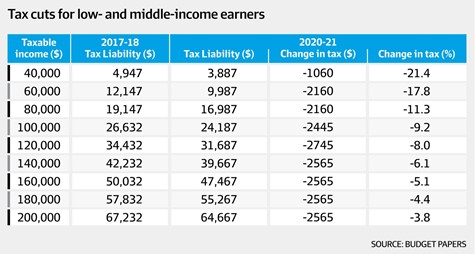

- Bringing forward the income tax cuts that were scheduled for 2022 to encourage household consumption

- Large business tax incentives to encourage businesses to invest, expand, and grow

- Jobs and manufacturing support to help bring down the unemployment rate, get young people employed, and re-train the labour force

- One-off social security support payment in two tranches to assist those already receiving support

- More funding for aged care, specifically for home-care packages to help Australians receive care at home

- State infrastructure support with “use it or lose it” payments and more money going to states who approve projects quickly

Some additional detail on critical areas as follows:

Income tax cuts – from July 2020, the top threshold of the 19% tax rate will increase from $37,000 to $45,000, whilst the top threshold for the 32.5% tax rate will increase from $90,000 to $120,000. The low-income tax offset will also be increased whilst the low-and-middle-income tax offset, which was due to be removed, will be retained for one more year. This is all about putting more money in the hands of households as JobKeeper and JobSeeker programs taper off.

Business tax incentives – a raft of changes here aimed at generating a business-led economic recovery in supporting business investment, expenditure, and expansion which will help create more jobs. Measures include temporary full expensing of eligible new capital assets for businesses with annual turnover less than $5 billion and full expensing of 2nd hand assets for businesses with turnover less than $50 million; temporary allowance for companies with annual turnover less than $5 billion to carry back tax losses from FY 20, 21, and 22 income years to offset previously tax profits in the FY 19 or later income years; increasing the small business entity turnover threshold from $10 million to $50 million which will give businesses up to 10 further tax concessions.

Jobs and Manufacturing – a raft of measures aimed at getting young people into work, encouraging training through apprenticeships, and support to the manufacturing sector to potentially bring back some manufacturing from overseas. Measures include paying a hiring credit for up to 12 months for each new job available to employers who hire employees age 16-35; a wage subsidy to support school leavers and workers displaced by the virus which will see businesses reimbursed by up to 50% of an apprentice of trainee’s wages worth up to $7,000 per quarter; the provision of $1.5 billion over 5 years to support the building of competitiveness, scale and resilience in the Australian manufacturing sector focusing on specialist areas (resources technology & critical minerals processing, food & beverages, medical products, recycling & clean energy, defence, space).

What does it all mean for the economy and local markets?

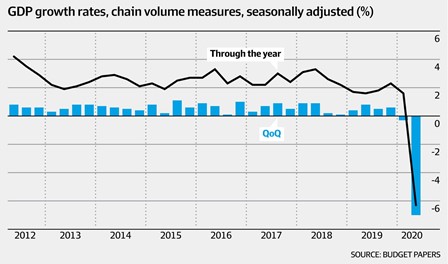

The much-needed stimulus will go some way to rectifying the economic damage caused by Covid-19 policies. The stimulus provided since March has resulted in a much smaller economic contraction than previously expected, whilst the stimulus provided in this budget is expected to result in a reasonably strong economic recovery next year.

The problem is the wide set of unknowns ahead, the assumptions baked into this budget, and the rather optimistic forecasts provided by the Treasury.

The key assumption for this budget is that a vaccine will be widely available and distributed by middle of 2021. That is a big assumption.

The unknowns ahead include things like state government responses to virus waves, continued state border closures, foreign border closure, effectiveness of virus treatments and vaccines (including willingness to take), continued work from home arrangements, continued bank repayment holidays, how many of those on JobKeeper will retain their jobs, how much of the changes we’ve seen in consumer and business behaviour are now permanent versus temporary, etc, etc.

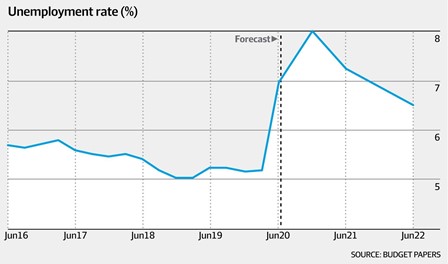

The budget papers include forecasts from Treasury on things like economic growth, unemployment migration, etc. These forecasts look anywhere from mildly to wildly optimistic against recent forecasts from the RBA, the big 4 banks, and other sources. Which will be proven right? Who knows?

All in all, the budget’s size and measures are both required and necessary and will place more money directly in the hands of consumers and business owners. The local equity market liked the budget with the ASX up at the time of writing. Time will tell whether the budget measures are enough or if more stimulus is required. What is clear is that both the Government and the RBA stand firm and ready to provide more stimulus as required.

If you’d like to discuss any of the points raised, please do not hesitate to contact us on 9324 8888.