15 May 2024

Australian Federal Budget 2024-25

May 2024 - Article provided by PSK's Chief Investment Officer Chris Lioutas.

The Federal budget was handed down last night by the Labor government with Treasurer Jim Chalmers and his government presiding over a $9.3 billion surplus, in trying to walk the very fine line between assisting cost of living pressures whilst not adding any further pressure on the RBA in their fight to bring inflation back to target.

As usual, the plethora of pre-budget announcements and leaks meant there were largely no surprises in the budget handed down. The outcome is one that largely keeps everyone happy in the short-term at the detriment of the longer-term – a common place result with regard to the election cycle.

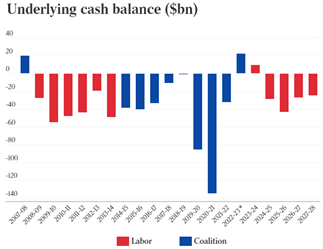

No doubt the Government and the Treasurer will celebrate the delivery of consecutive surpluses, but the budget papers make clear again that the surplus has nothing to do with government decisions and all to do with temporary revenue windfalls (commodity prices, tax receipts) that are expected to fall away in the coming years.

Attempting to solve a cost-of-living crisis is a noble cause, and one to be commended in the current environment, but any relief (which is in effect spending) must come with equally responsible spending cuts or tax increases elsewhere, otherwise it will be inflationary.

The measures announced won’t necessarily make the RBA’s job any harder, but it certainly won’t make it any easier, with most forecasters now pushing any interest rate relief out until 2025.

Key take-aways include:

- The government expects to deliver a $9.3 billion surplus, its second successive surplus and a $10.5 billion improvement from the forecast in the mid-year update.

- The surplus is expected to disappear in the coming financial year and onwards as a result of forecast falls in commodity prices, higher unemployment (smaller tax base), and a slowdown in wages growth (tax receipts).

- The Treasurer expects to run combined deficits of $122 billion over the next four years to accommodate more than $32.5 billion in new spending.

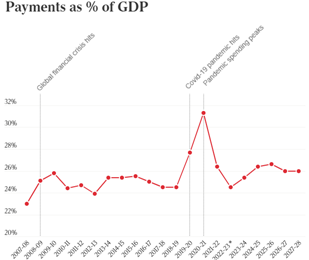

- The treasury expects gross debt to peak at 35.2% of GDP in 2026-27 before declining to 30.2% by 2034-35. Gross debt this year will be $904 billion.

- The government is forecasting the budget will reduce economic growth to 2% for the coming financial year and then 2.25% for the next financial year, lower than forecast in the mid-year budget.

- Given the economic slowdown, the government expects unemployment to lift to 4% by June 30, and then to 4.5% next year.

- Treasury is now forecasting inflation could fall into the 2-3% target band by the end of this year and be down to 2.75% by the middle of 2025. Both of these are better than the RBA's current forecasts.

- Superannuation contribution cap adjustments will start on 1 July, with the pre-tax cap moving to $30,000 and the post-tax cap moving to $120,000 per annum.

The winners include:

- Taxpayers – all taxpayers will receive a tax cut on 1 July through already legislated stage 3 cuts, delivered by the previous Coalition government but revised by Labor earlier this year.

- Households – every household in Australia will receive $300 off their energy bill through a rebate.

- Small businesses – some small businesses will receive $325 off their power bills; the $20,000 instant asset write-off scheme has been extended.

- Renters – Commonwealth Rent Assistance to be increased by a further 10%, on top of a 15% increase last year. One million households to benefit.

- People who use medicines listed on the PBS – the maximum co-payment for prescriptions on the PBS will be frozen for a year. For those on the aged care pension and concession card holders, the maximum co-payment will be frozen for 5 years at $7.70 per prescription.

- Pensioners – in addition to the PBS freeze above, pensioners will benefit from the deeming rate being frozen for another year.

- Students – changes to student debt re-indexation, which has been backdated to last year and will wipe $3 billion off the nation’s HECS debt.

- Housing sector – developers, tradies and social housing providers will benefit from $4.3 billion in new housing expenditure, including fast-track of visas for 1,900 migrants to work in housing construction.

The losers include:

- Most JobSeeker recipients – no increase to the maximum JobSeeker rate

- Alcohol producers – local breweries and distilleries were hopeful the government would pause increases in alcohol excise to assist local craft breweries which have been struggling. No pause eventuated.

- NDIS fraudsters – the government is going to spend a fair amount of money on cracking down on NDIS fraud and spiralling NDIS costs. Long overdue.

- Would-be migrants and international students – capping of both numbers over the next few years.

- High-income earners – they will still benefit under the stage 3 tax cuts, but the revision made by the government earlier this year will see that benefit halve.

- Public service contractors – the government will reduce spending on external labour including consultants and contractors.

Relevant charts shown below.

Source: Budget Papers, The Australian

Source: Budget Papers, The Australian

Source: Budget Papers, The Australian

As always, if you have any questions or your personal circumstances have changed please do not hesitate to contact your financial adviser.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.